Backing the Future

of Human-Machine

Collaboration

Backing the Future

of Human-Machine

Collaboration

Backing the Future

of Human-Machine

Collaboration

RoboStrategy is an actively managed fund

focused on robotics.

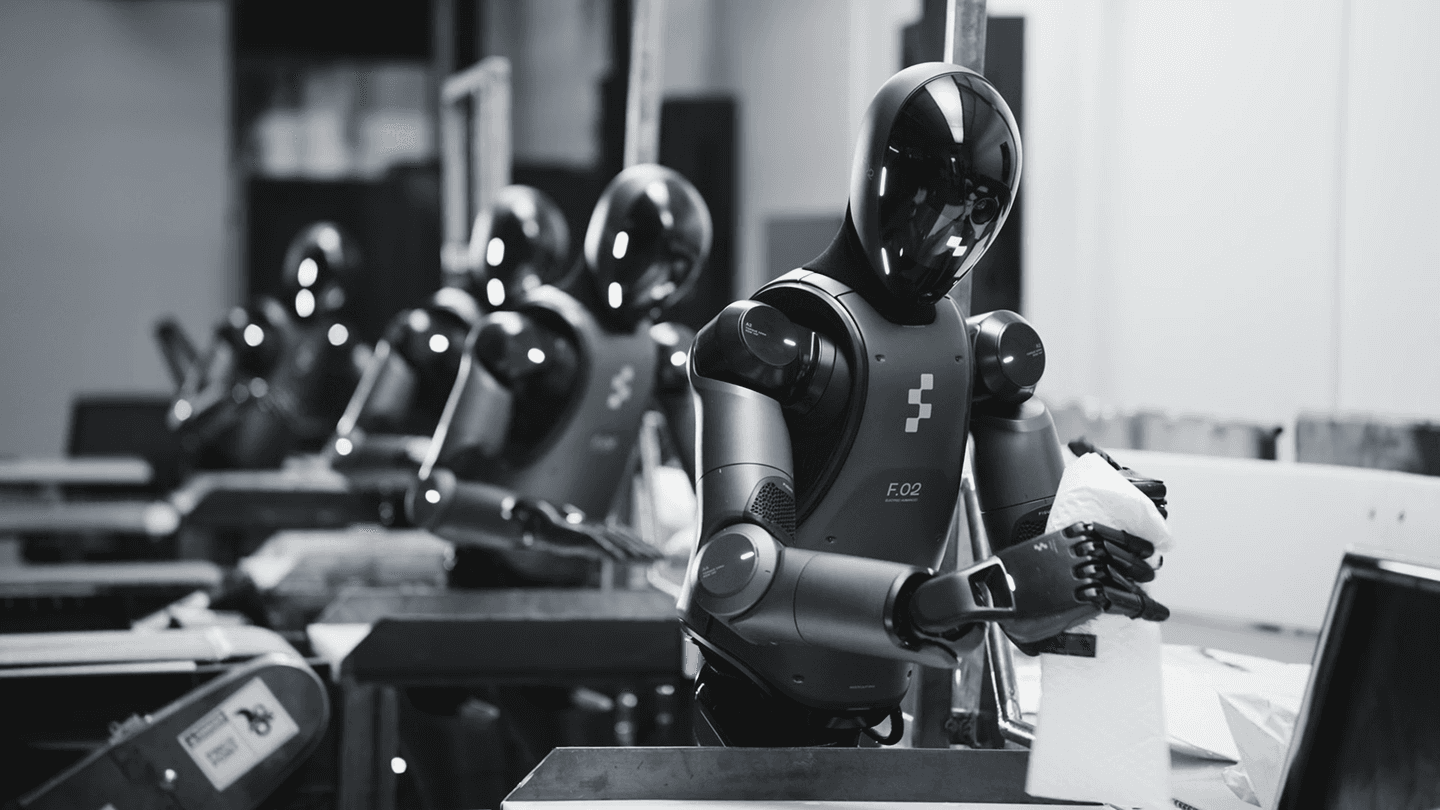

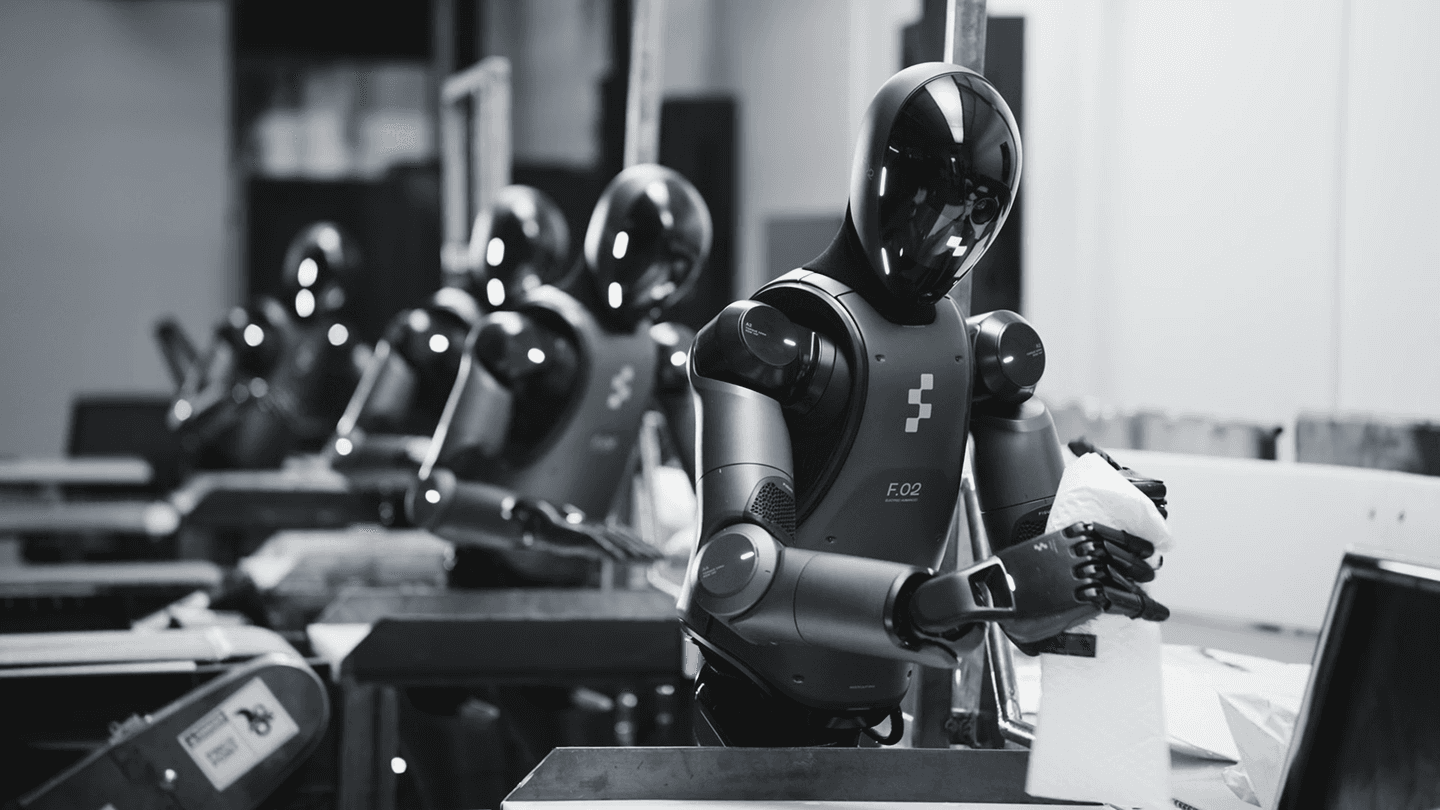

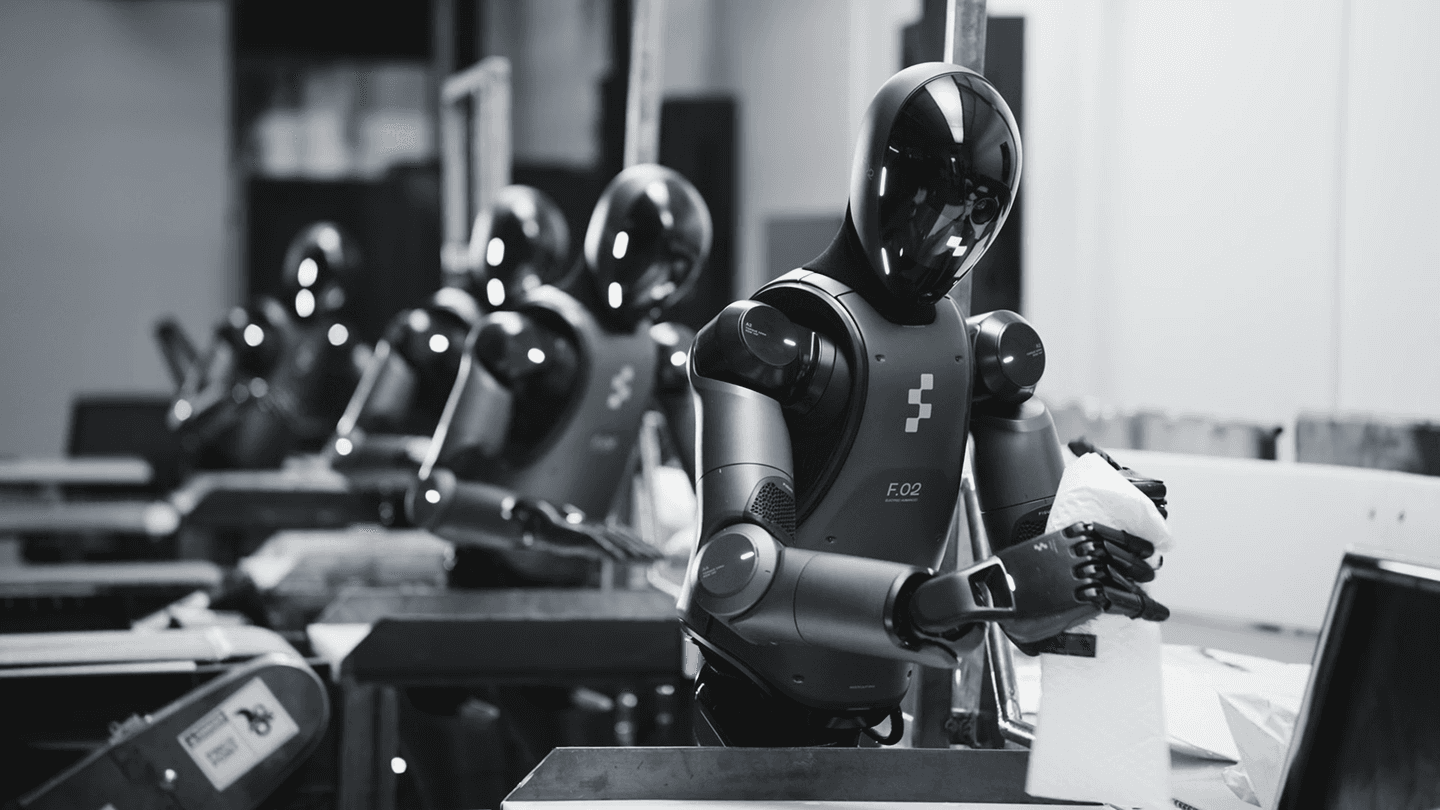

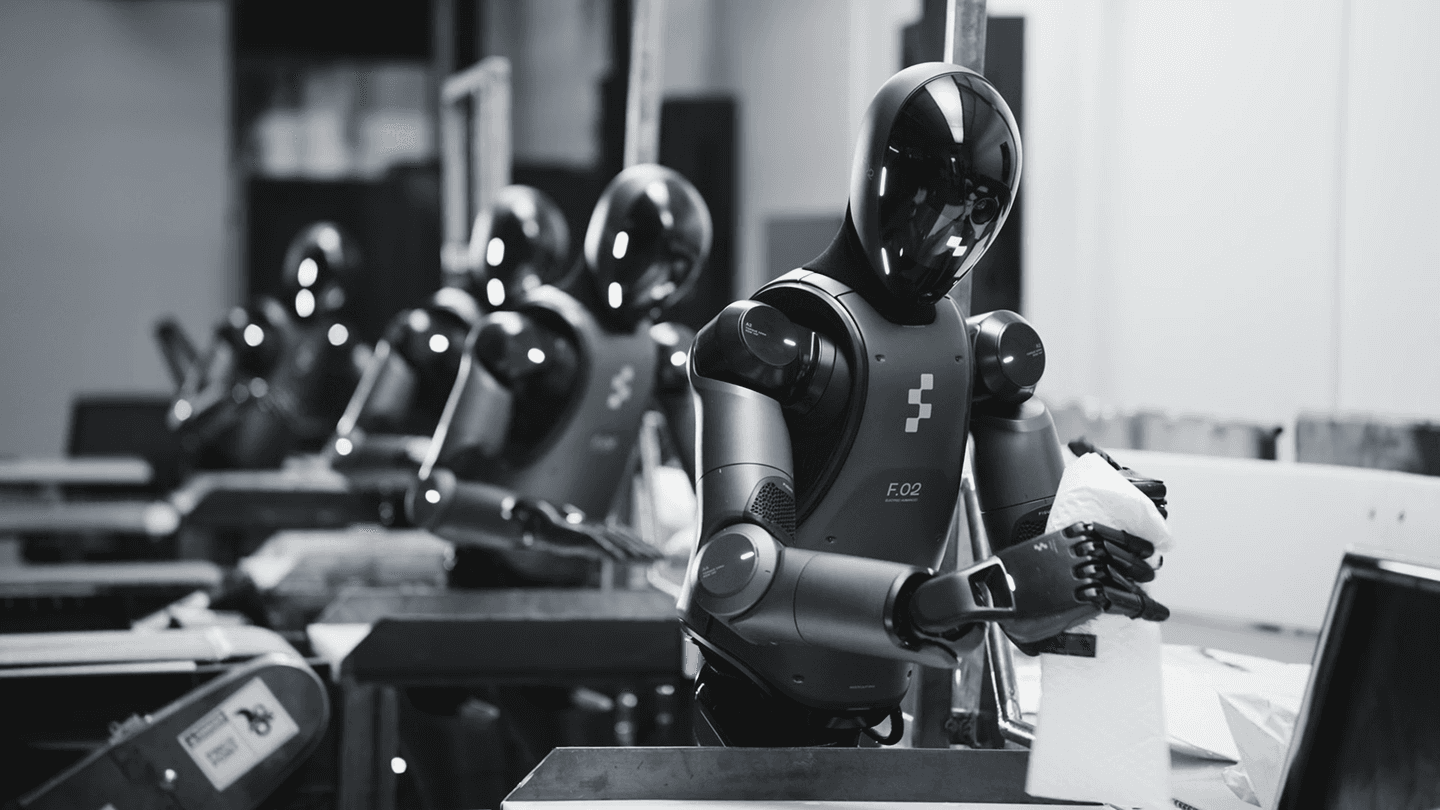

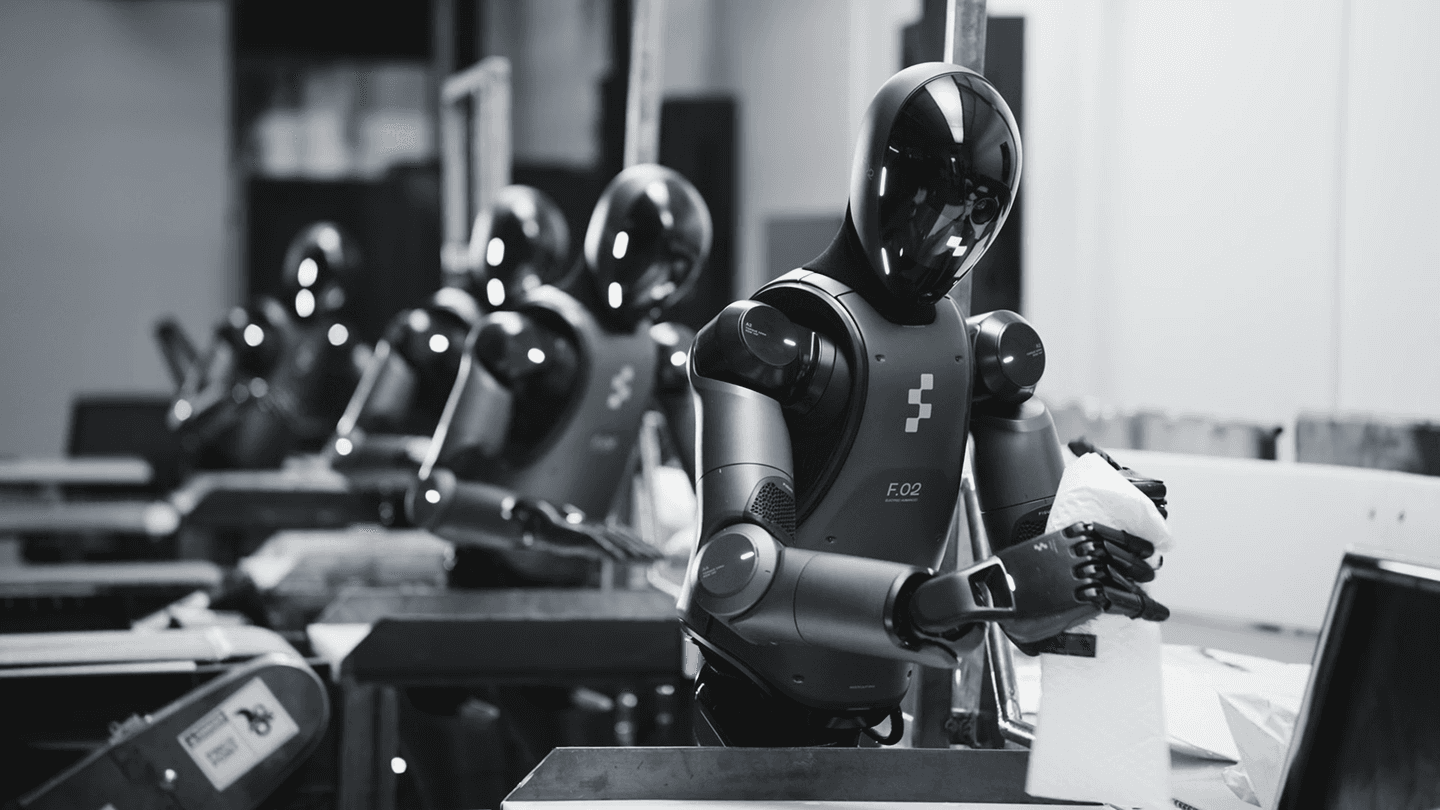

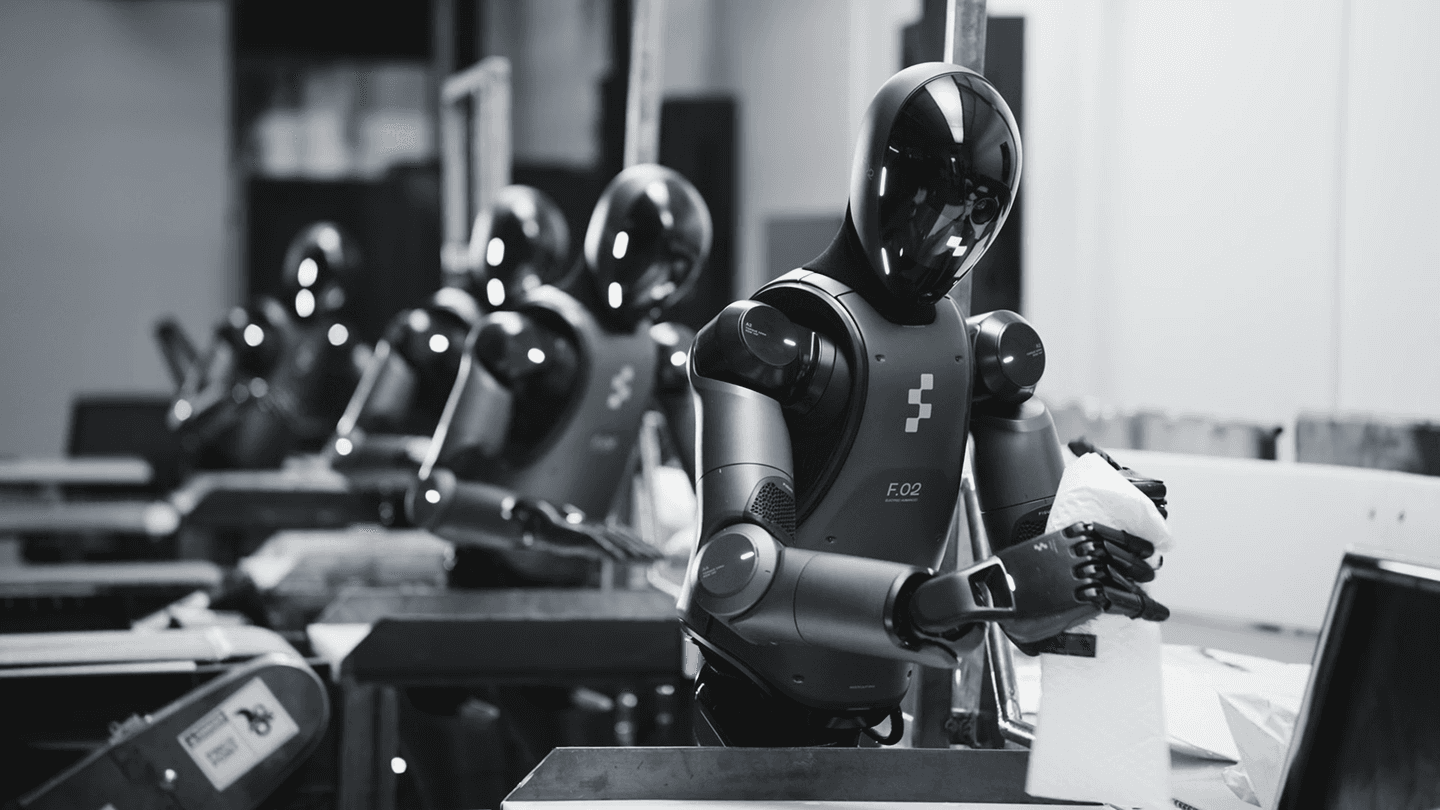

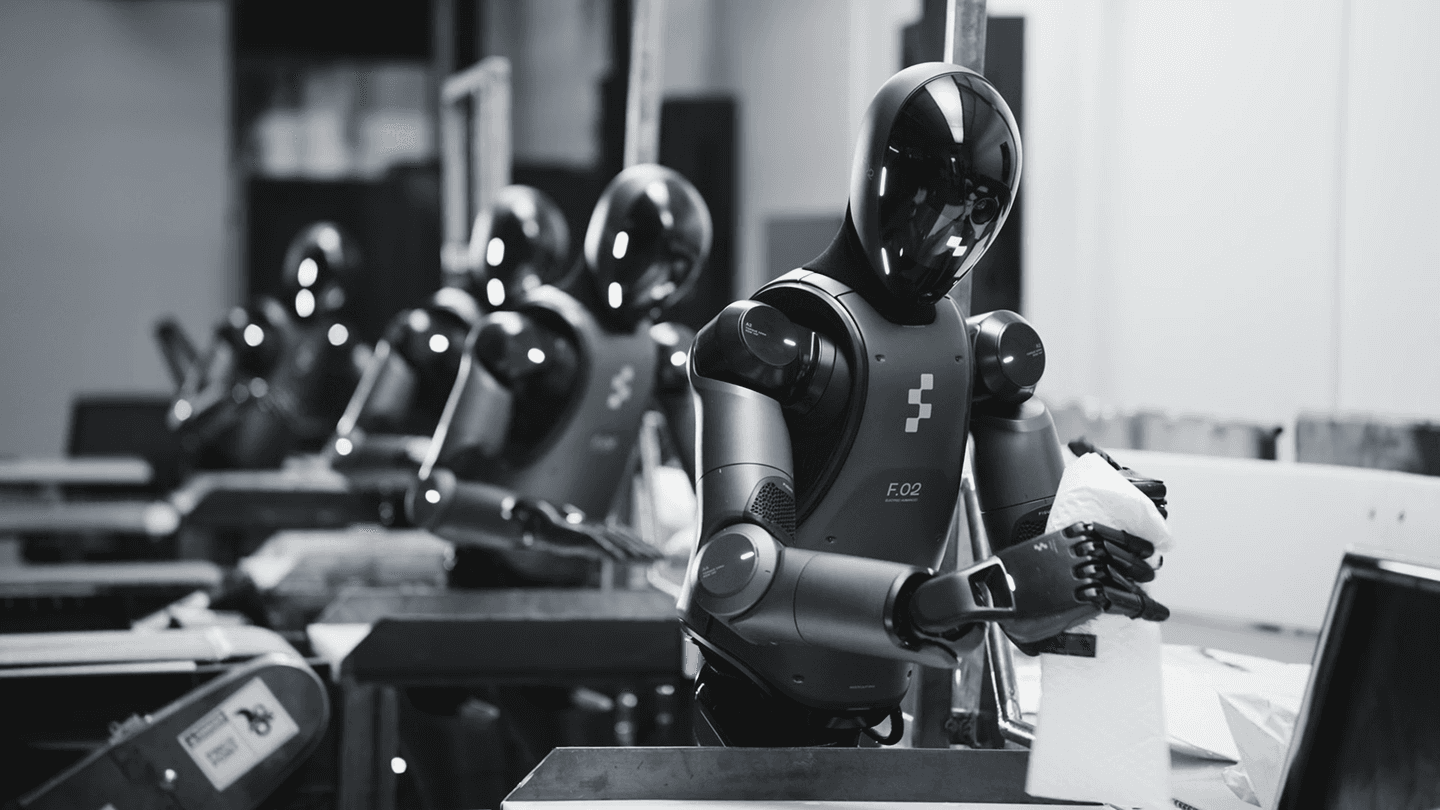

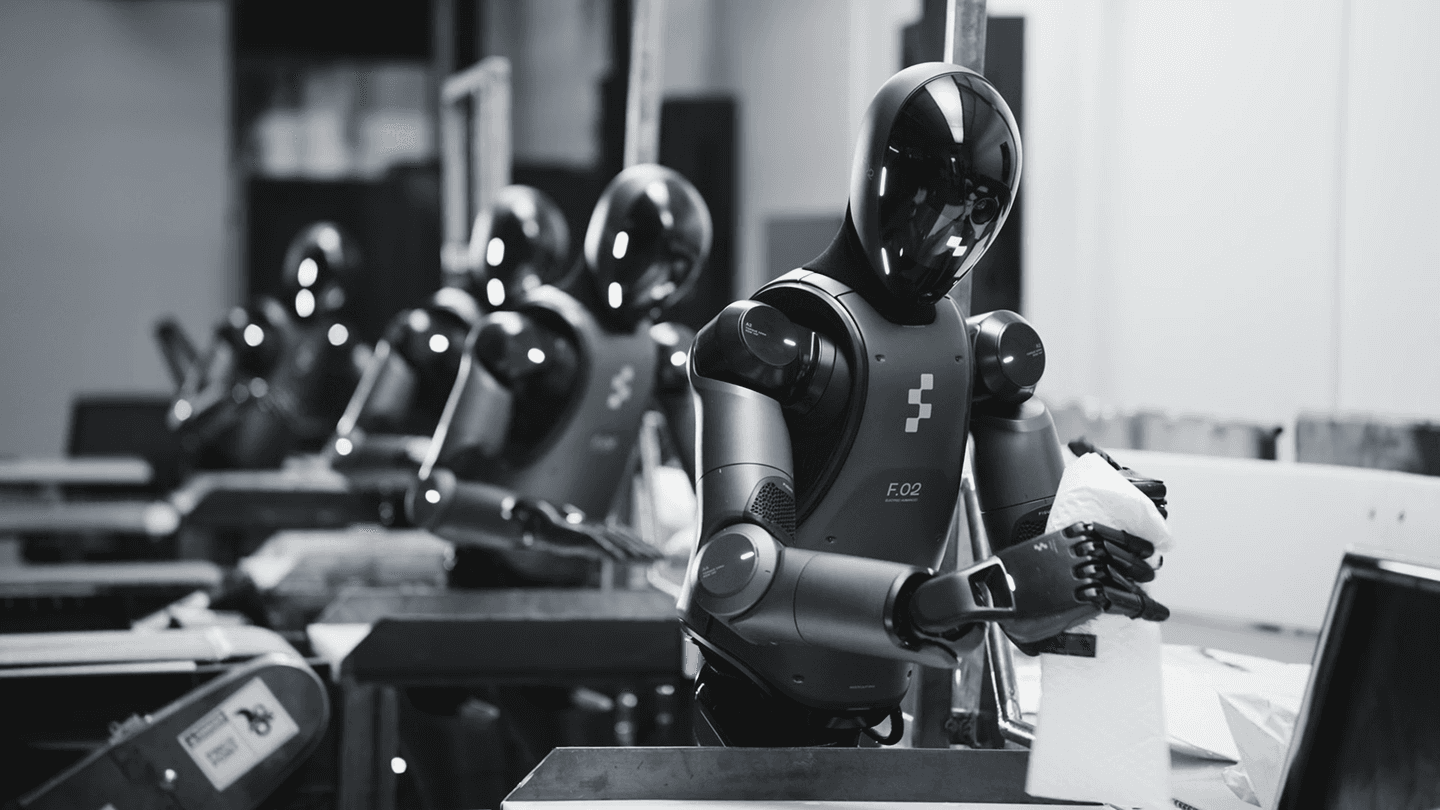

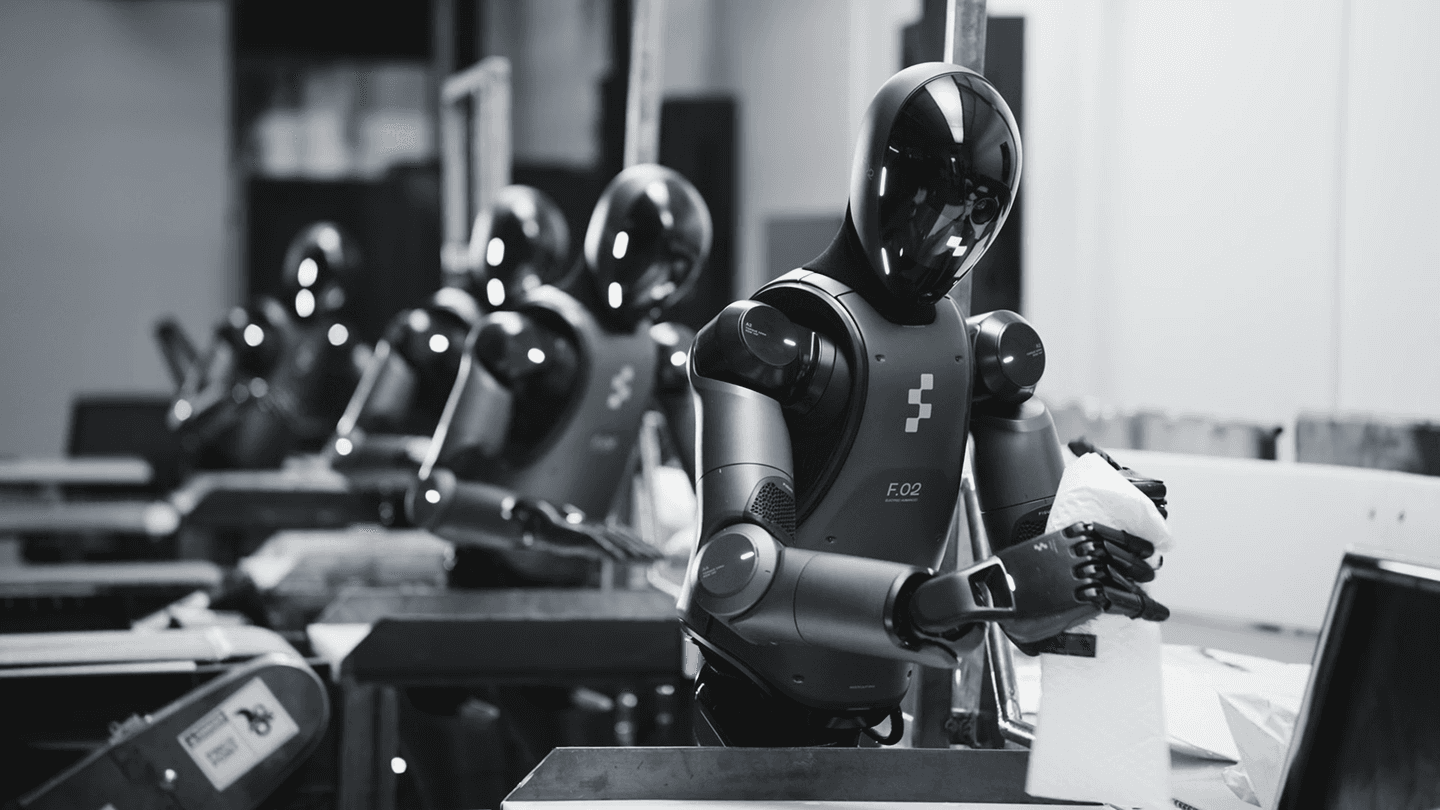

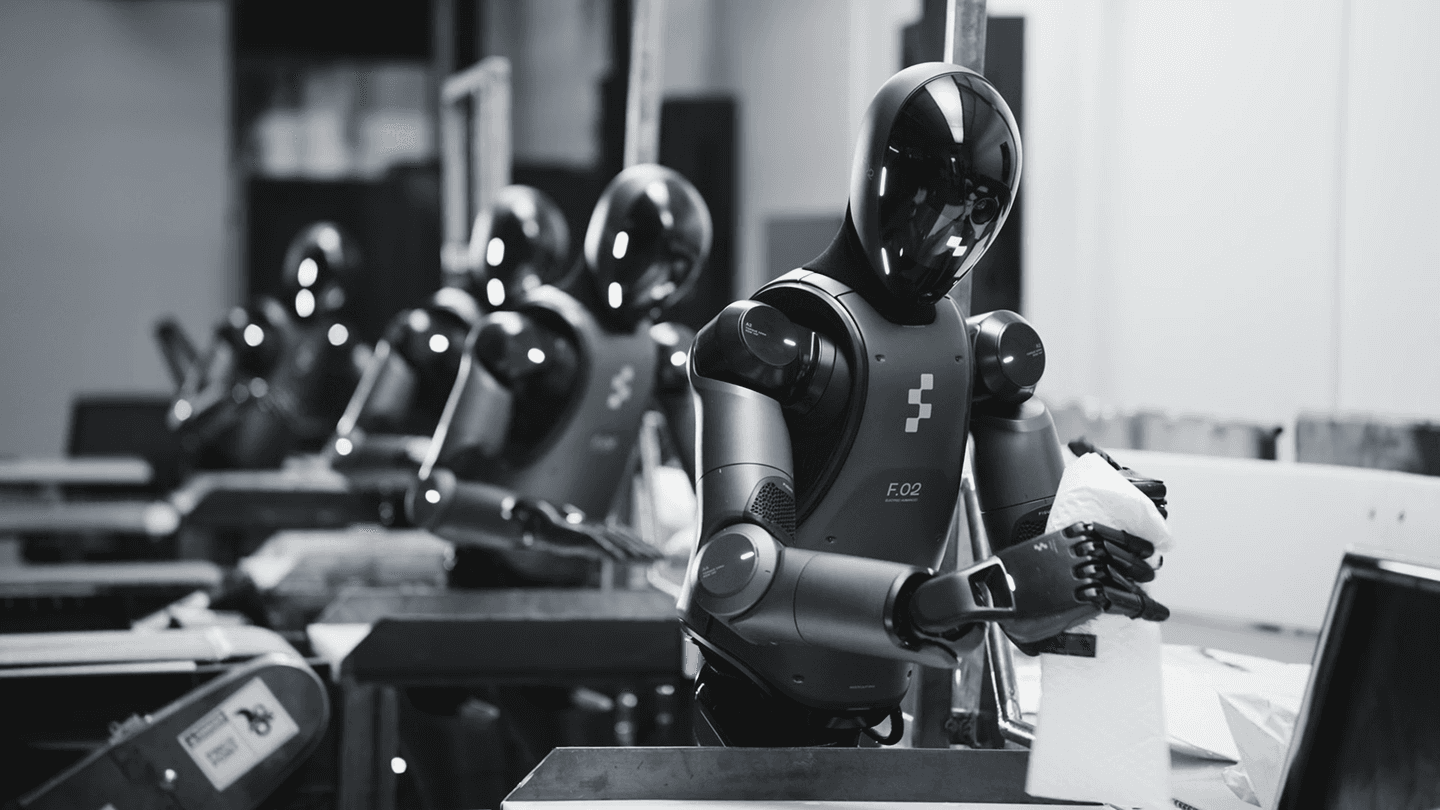

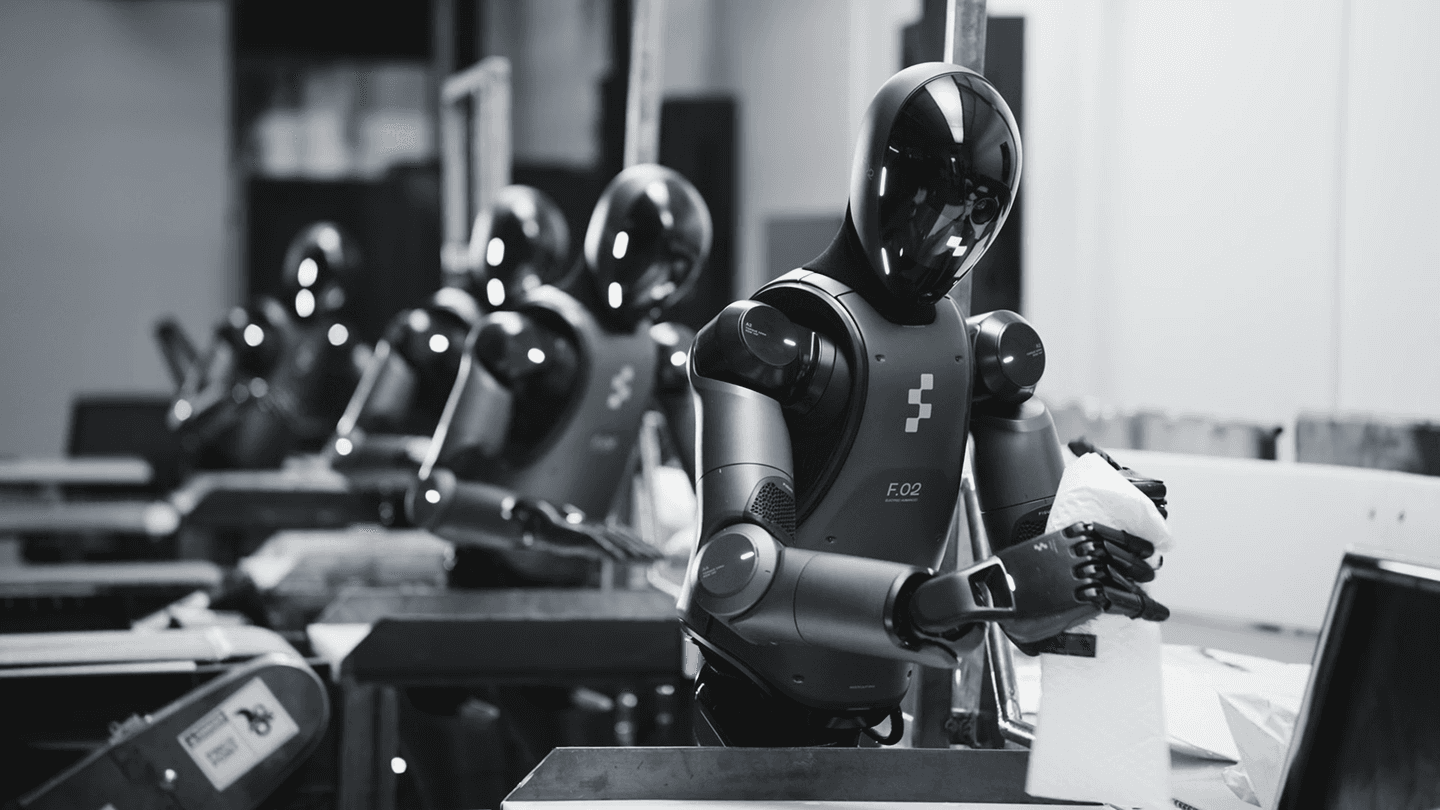

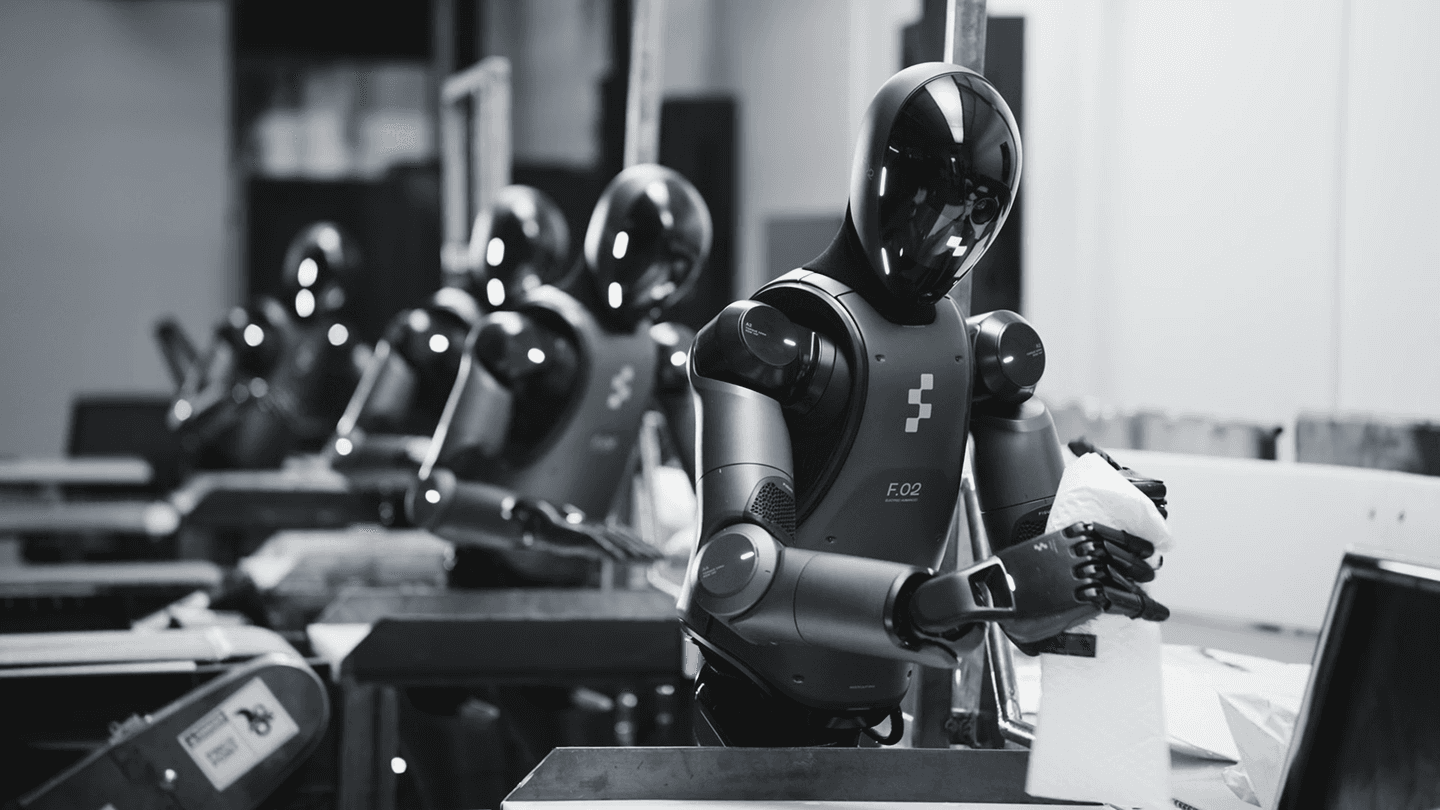

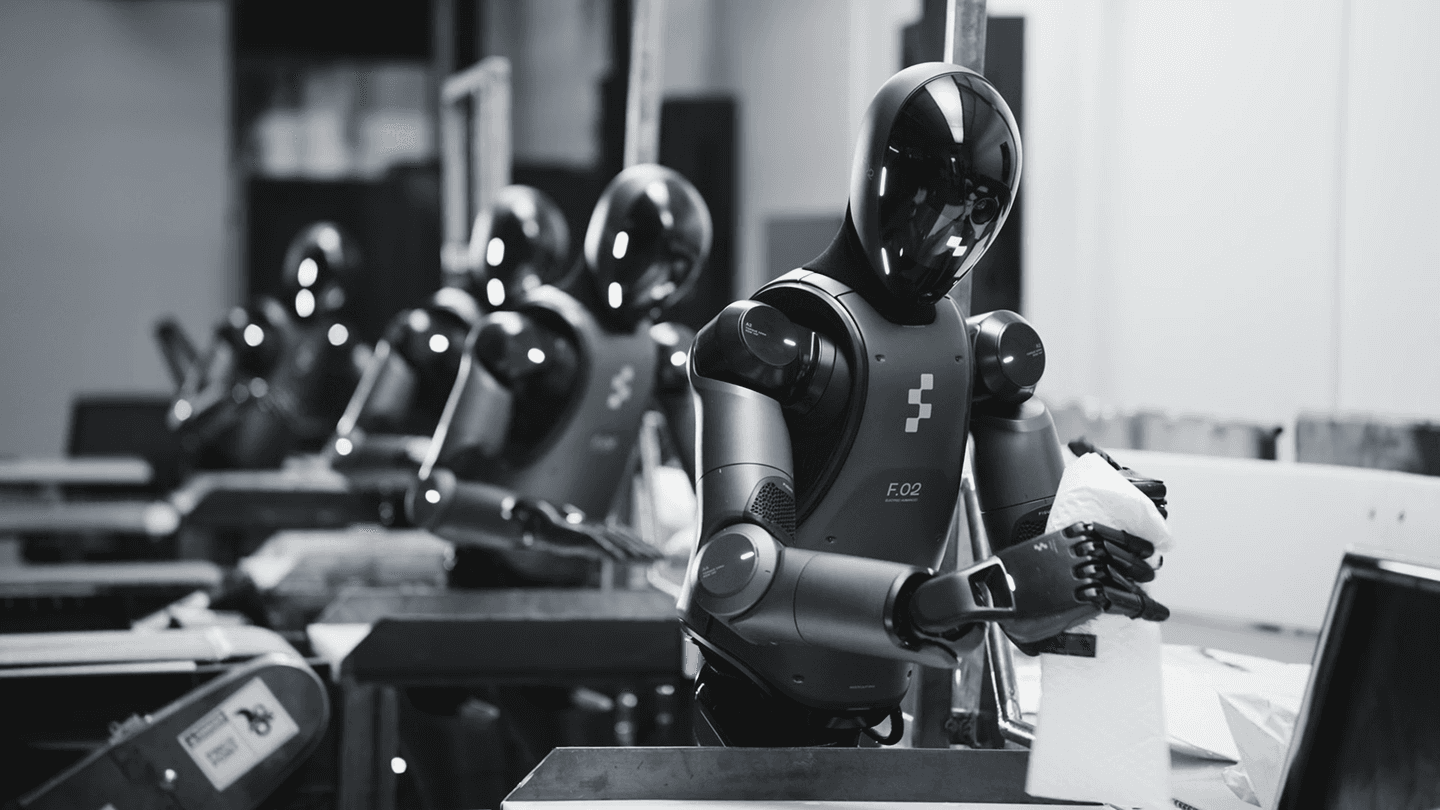

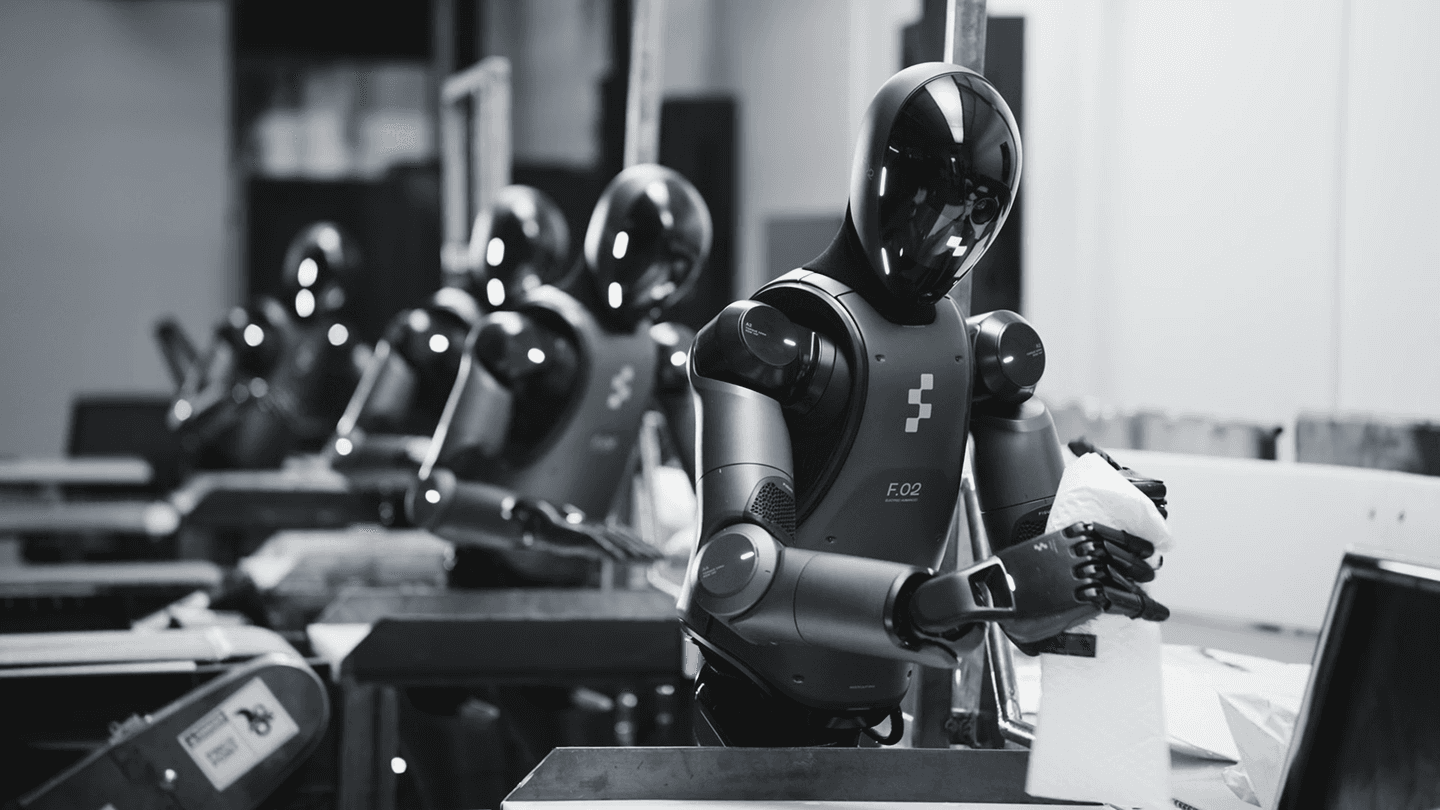

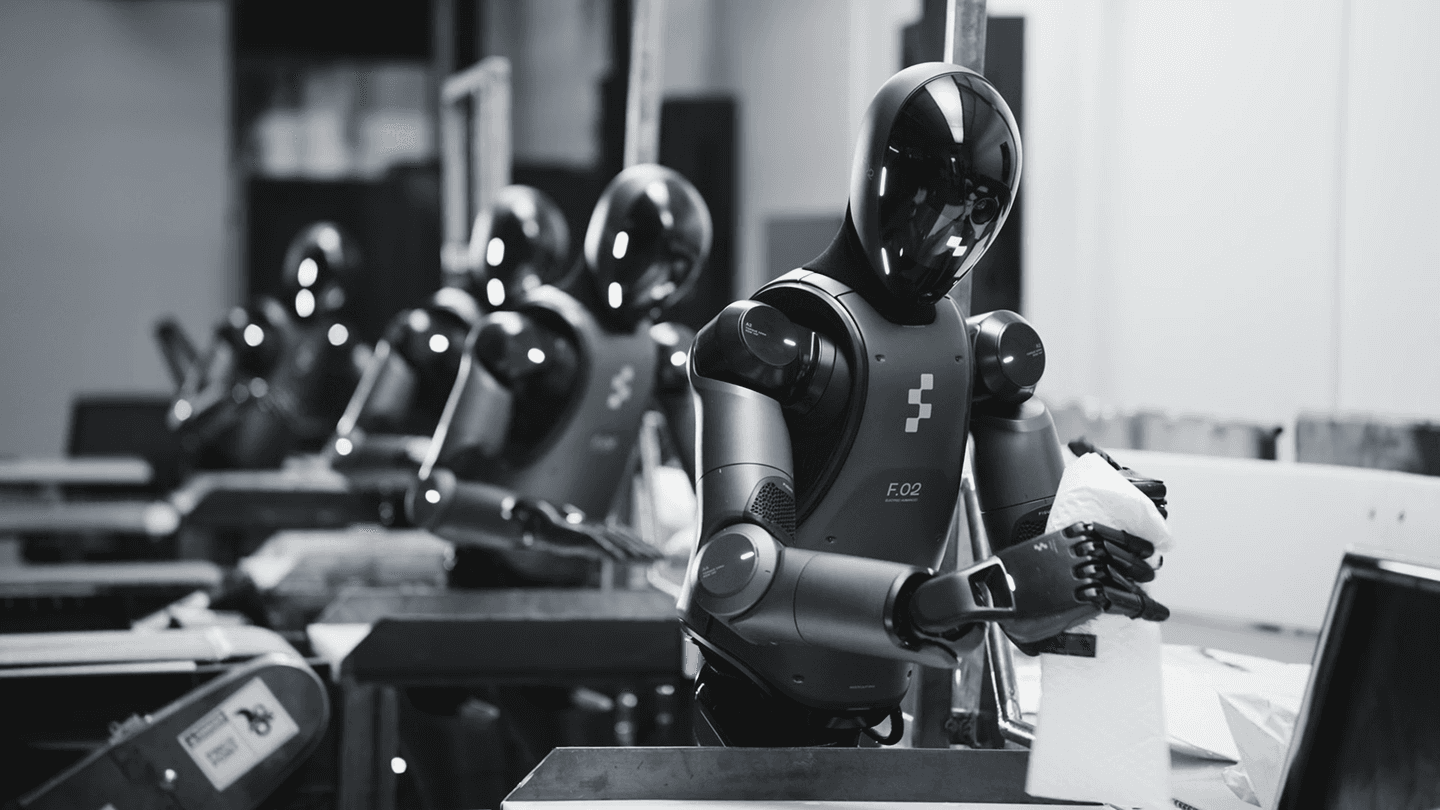

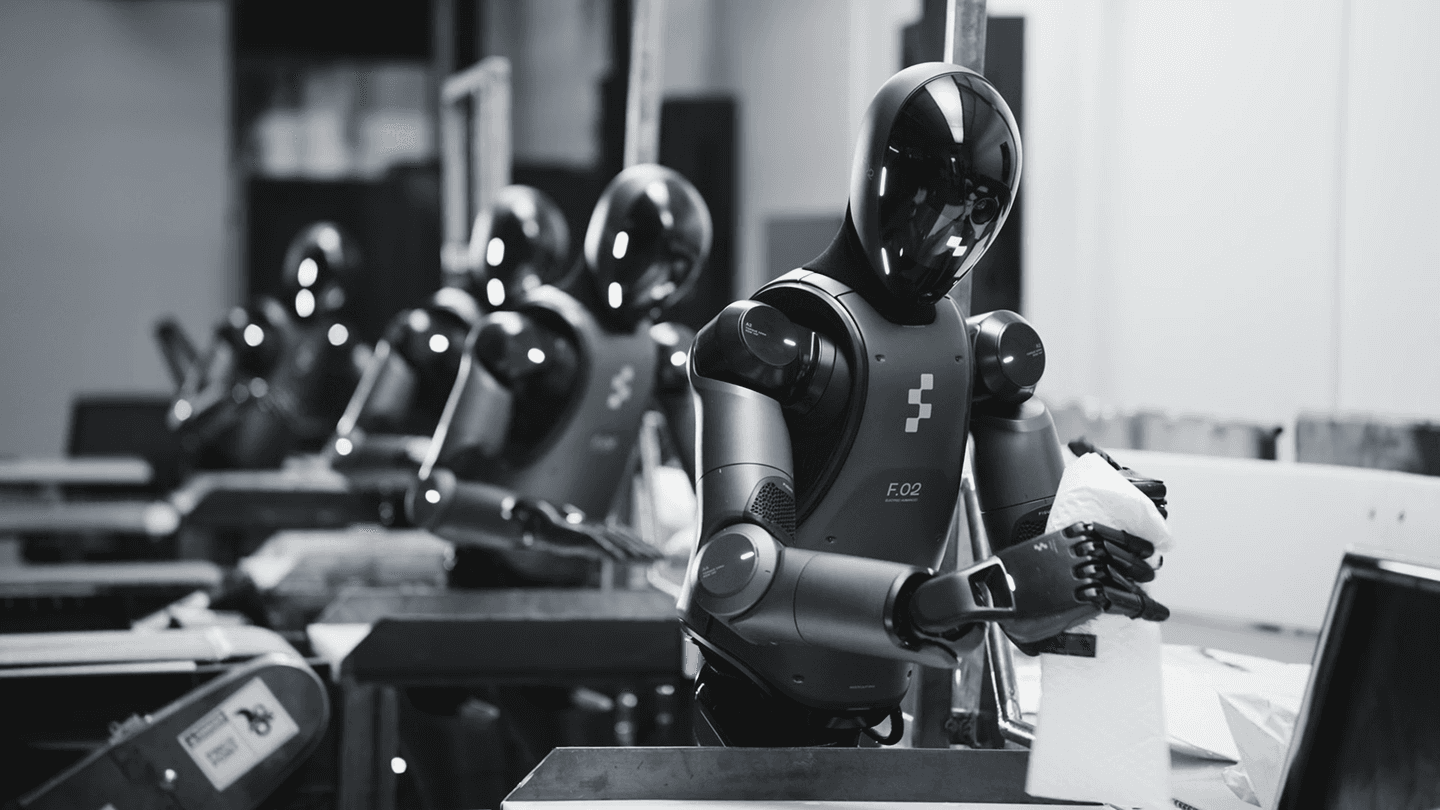

FIGURE

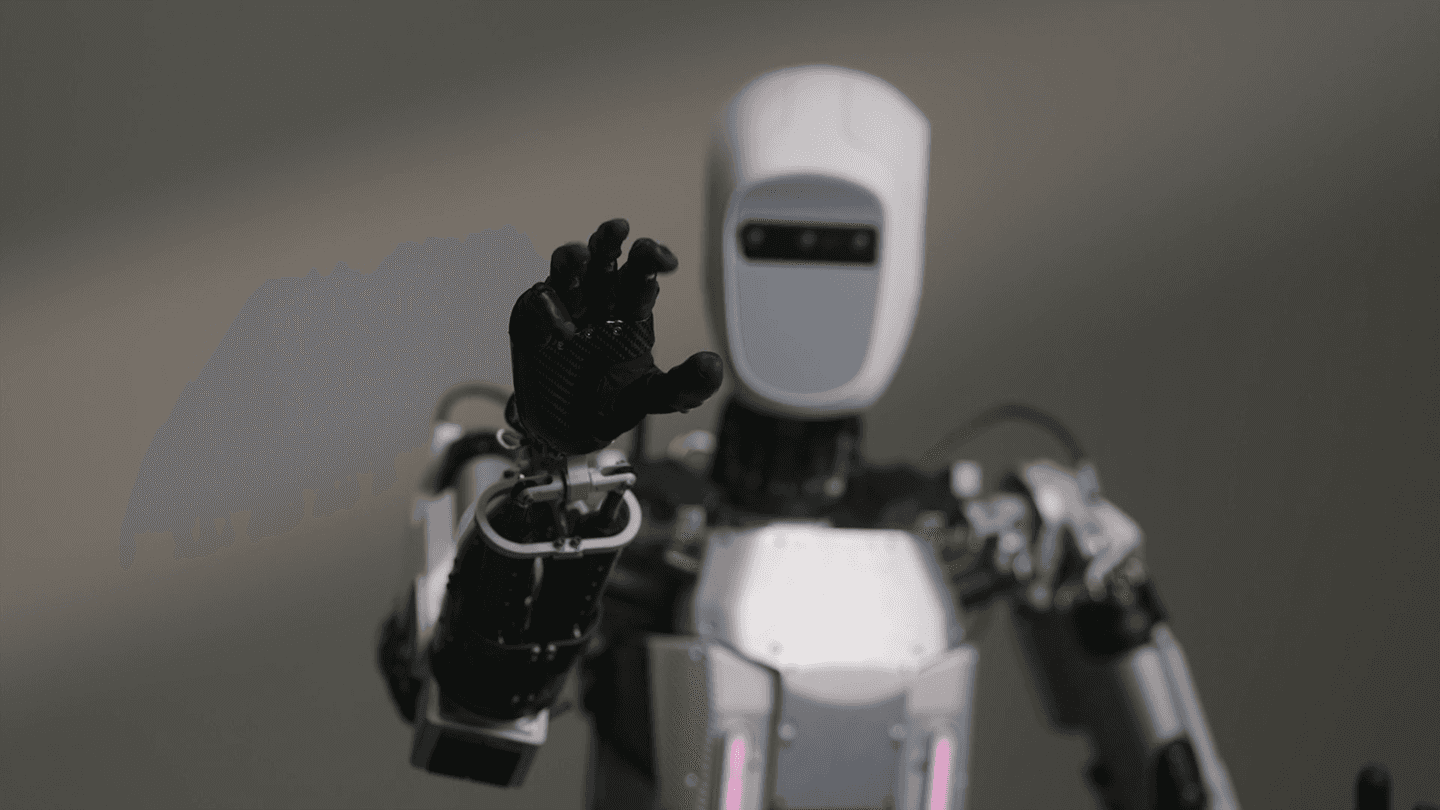

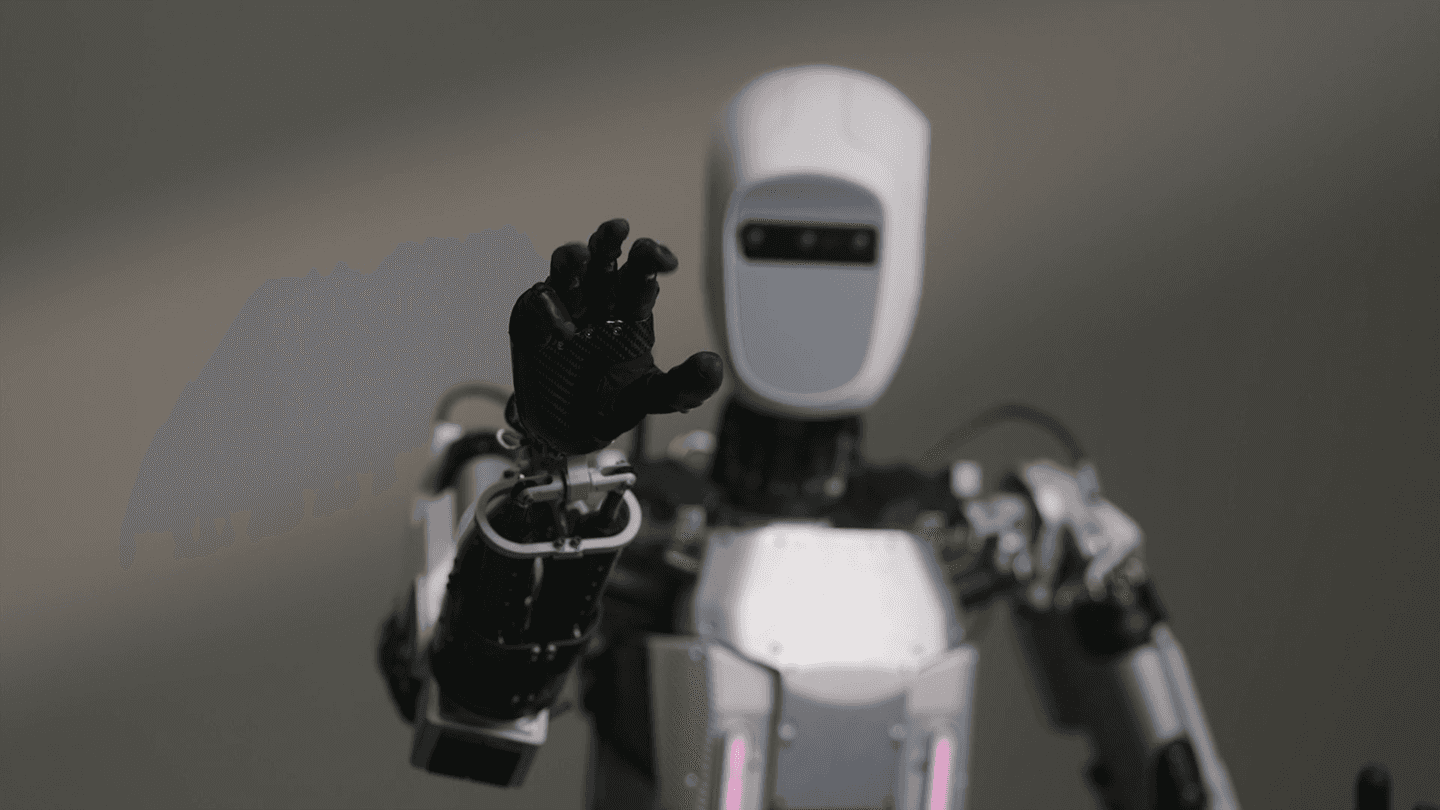

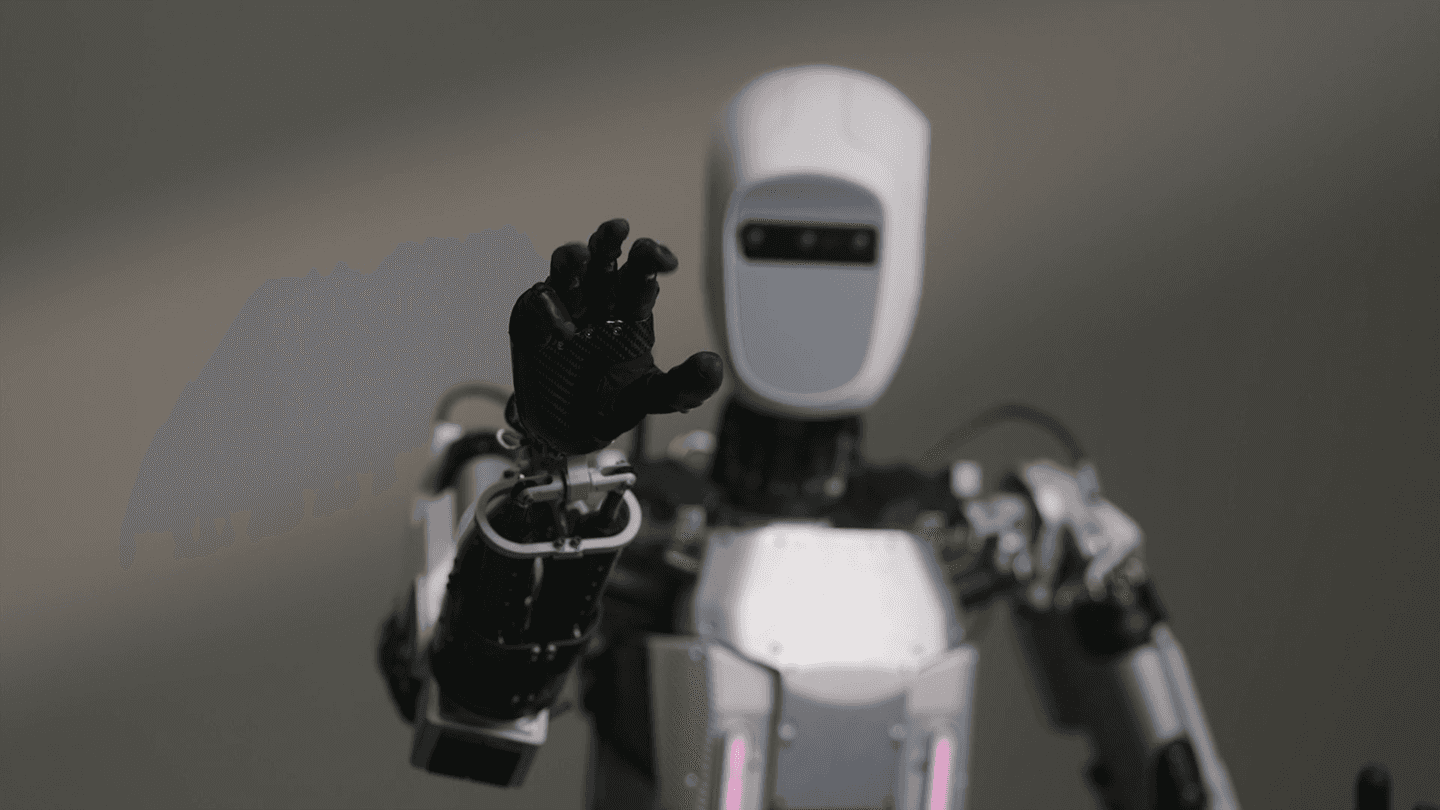

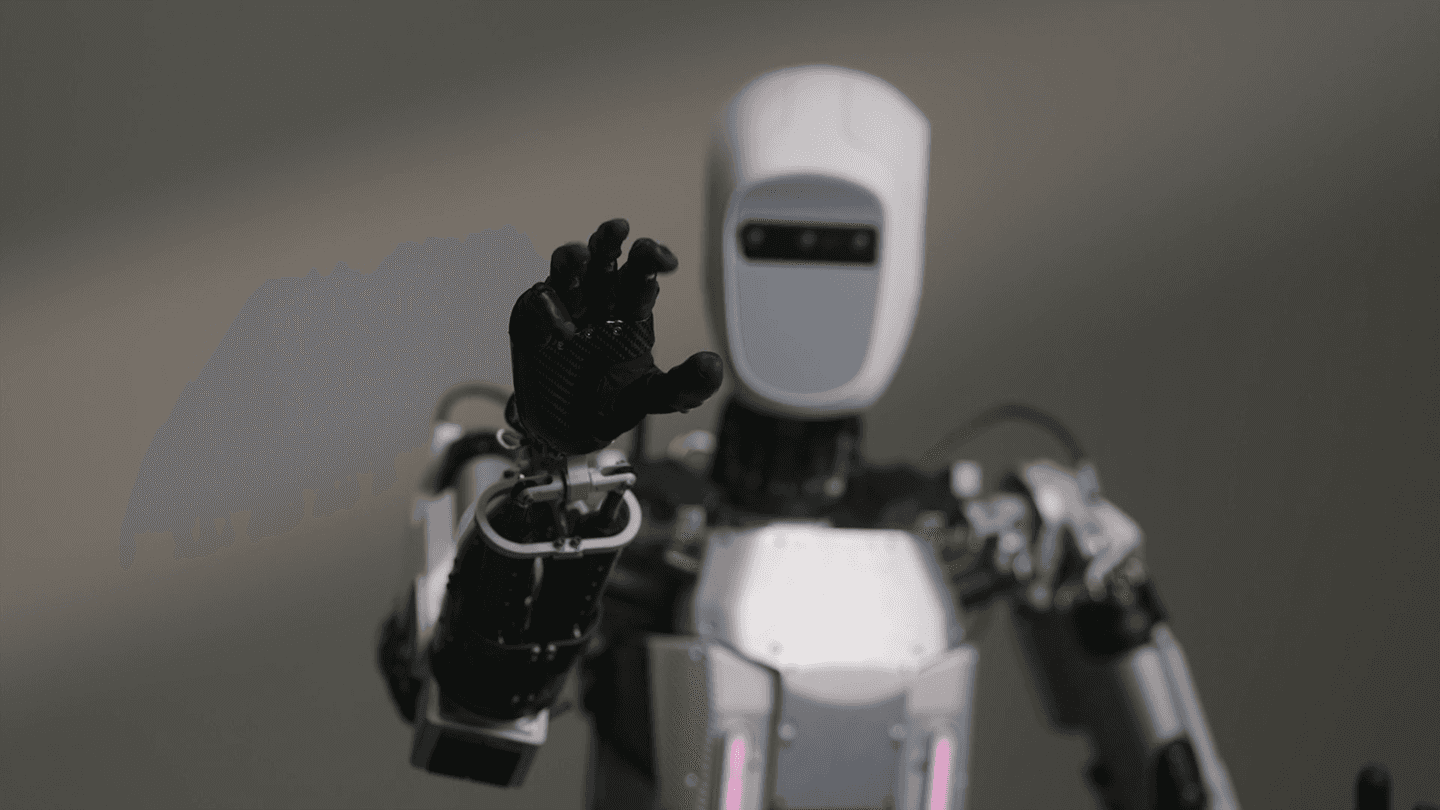

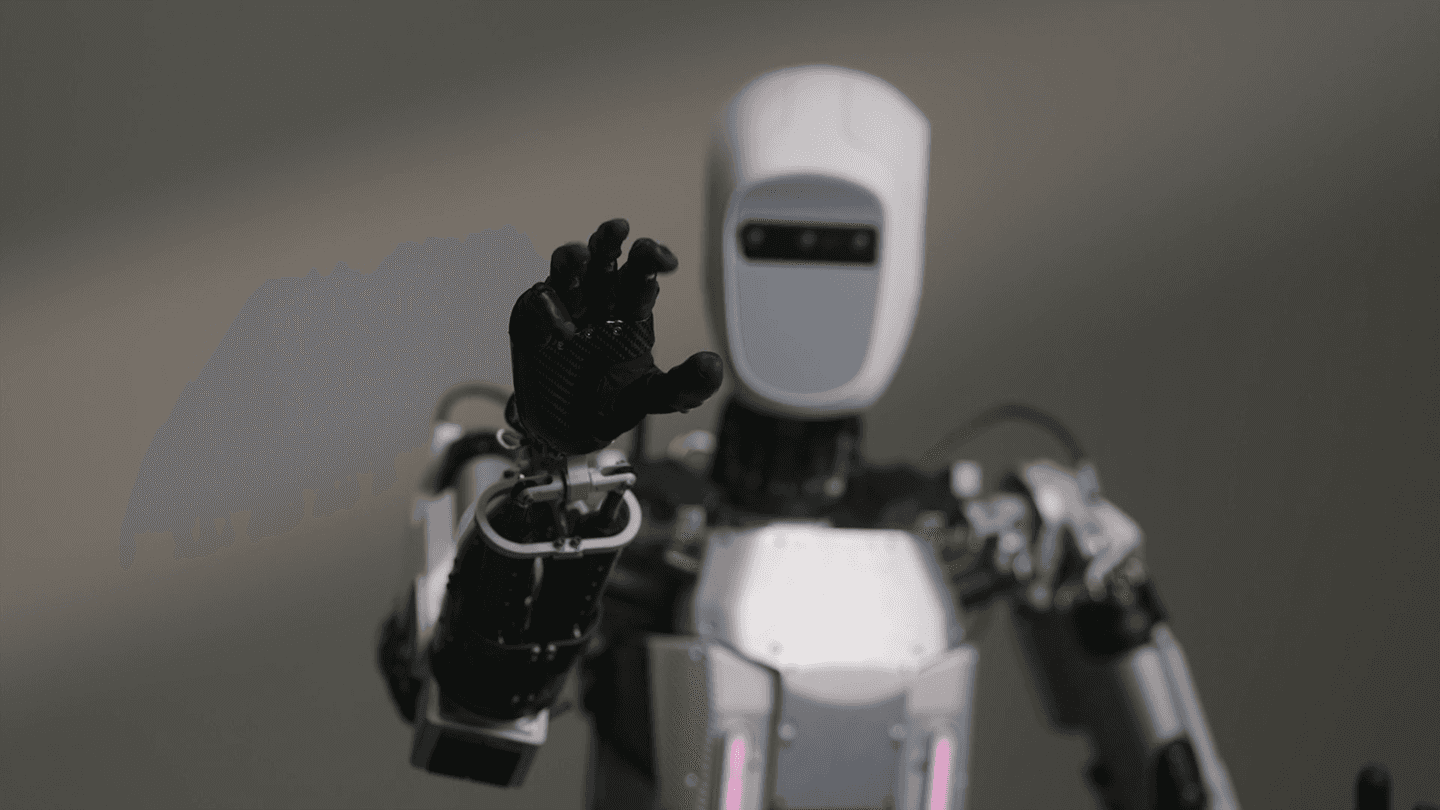

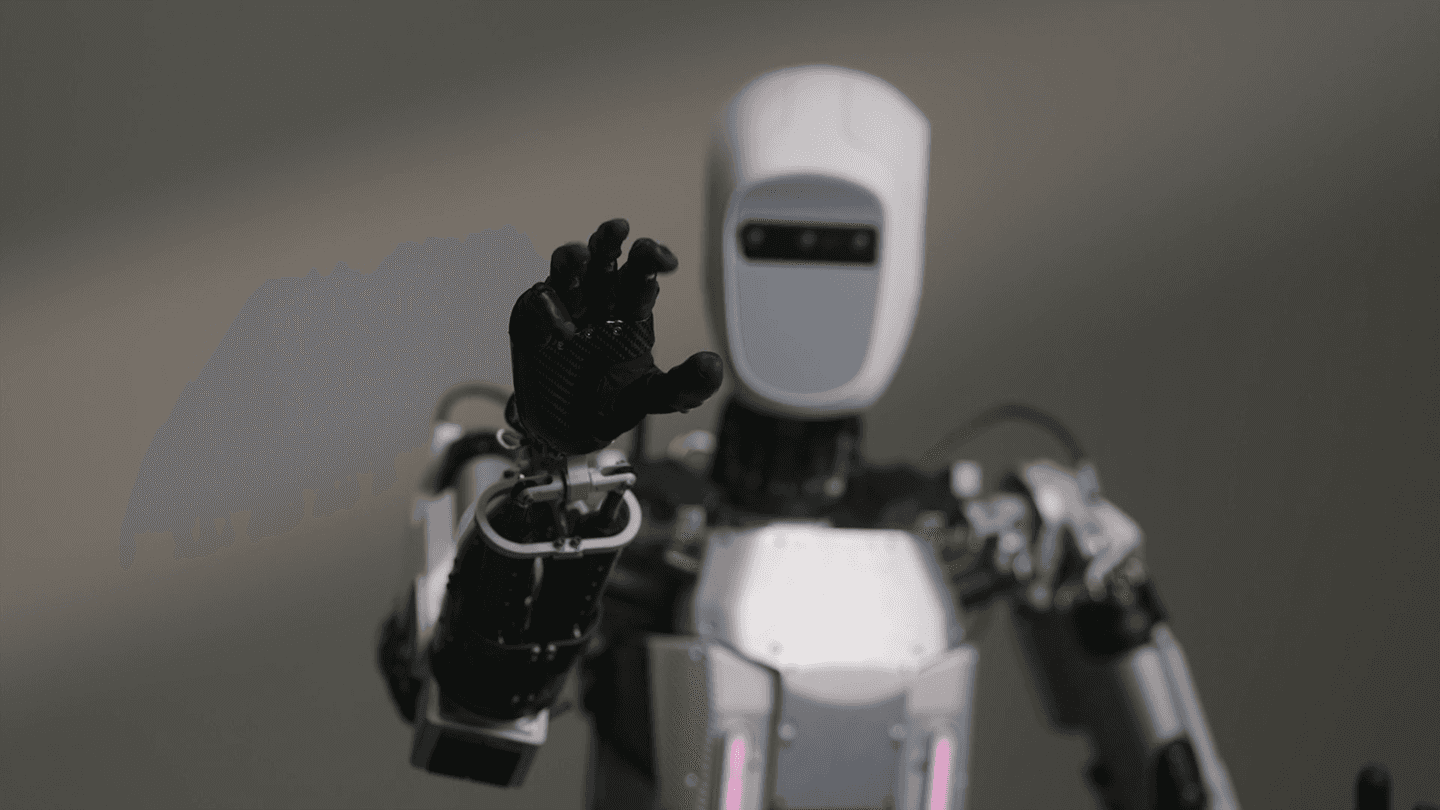

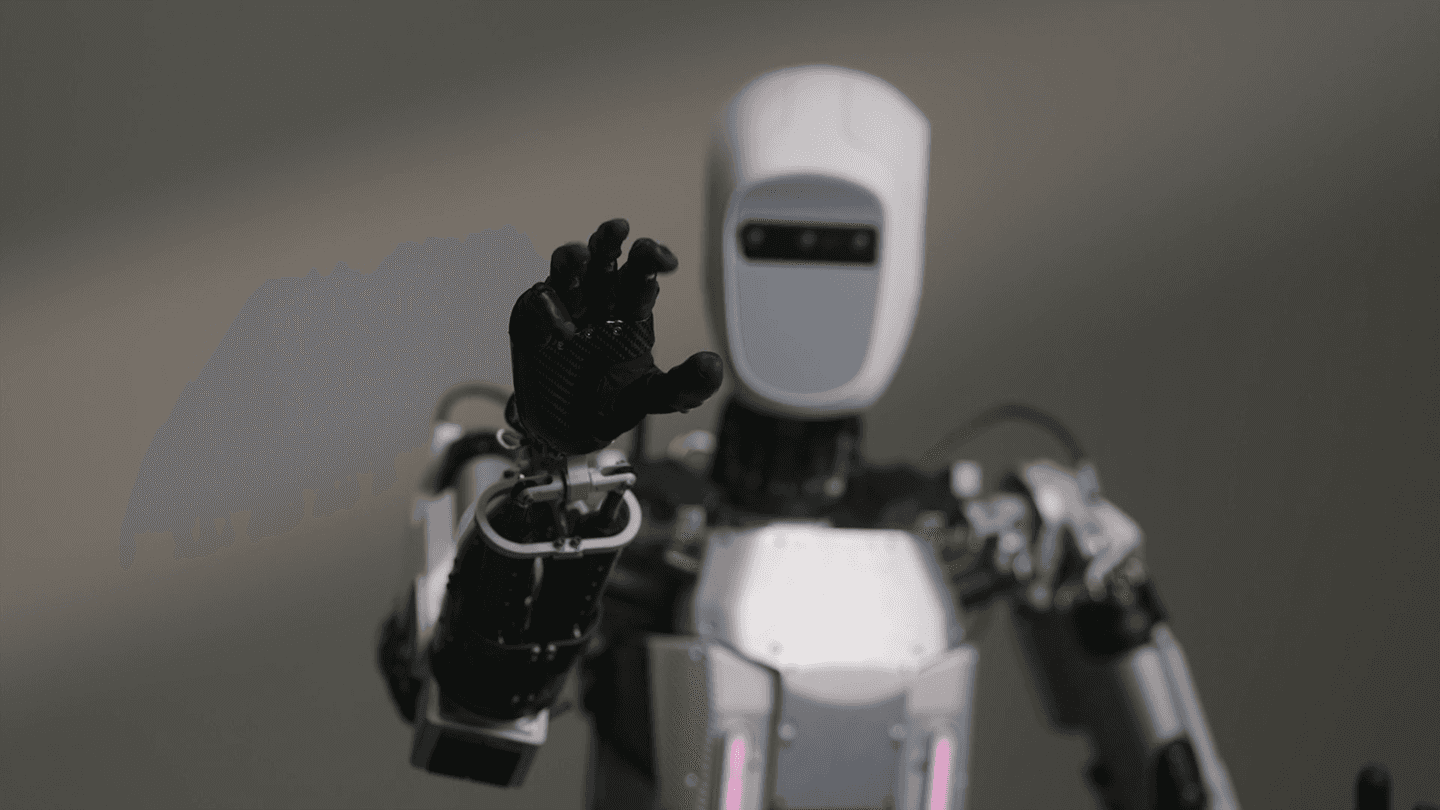

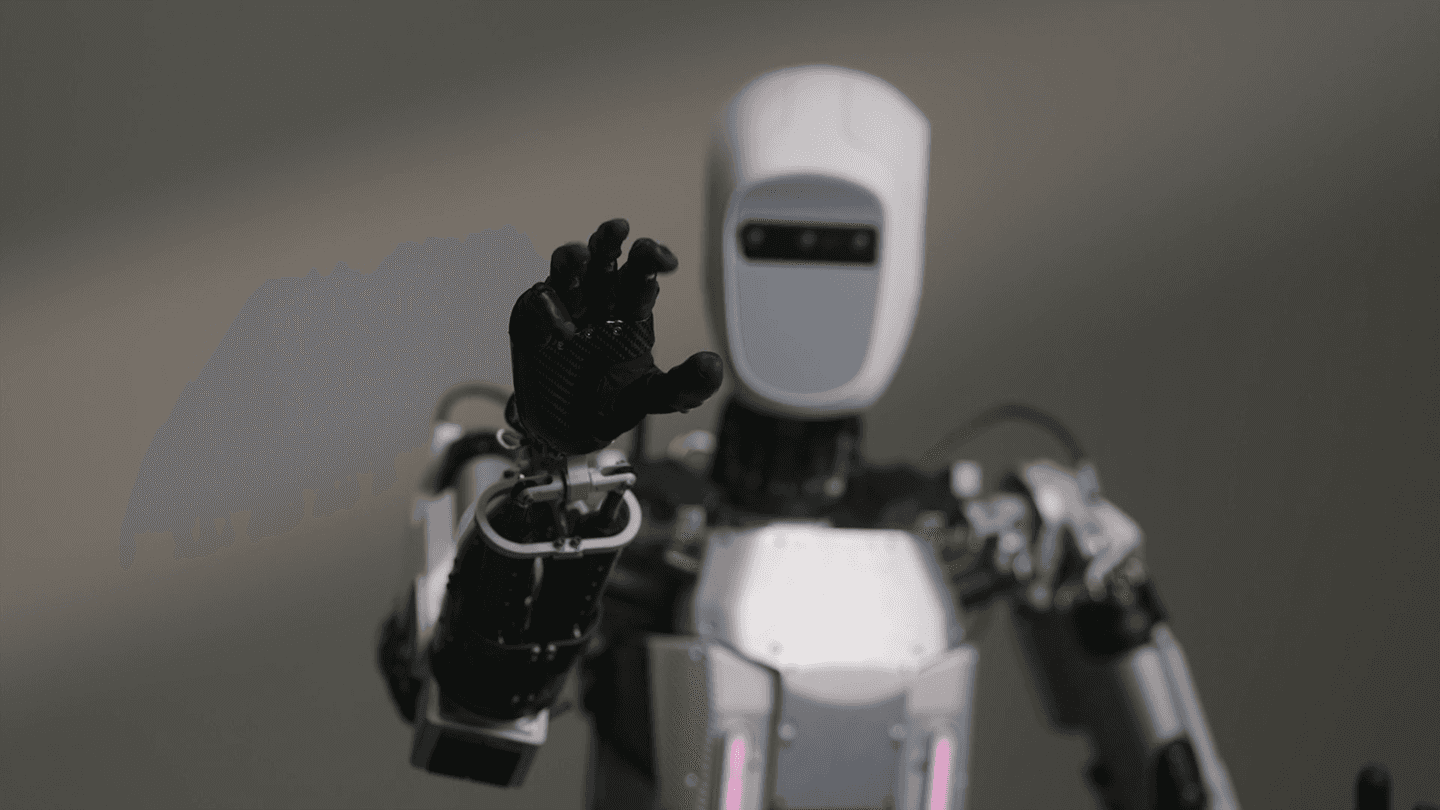

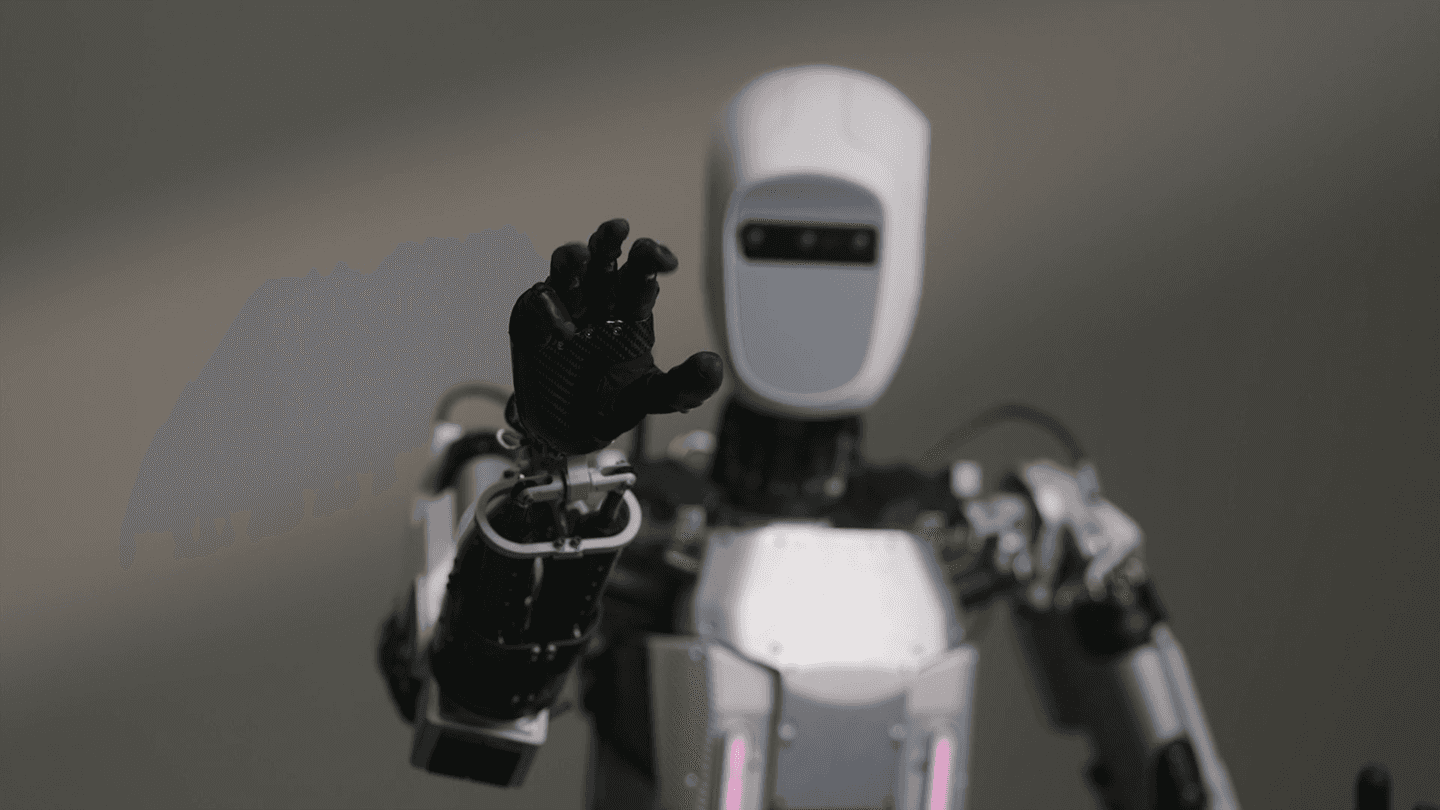

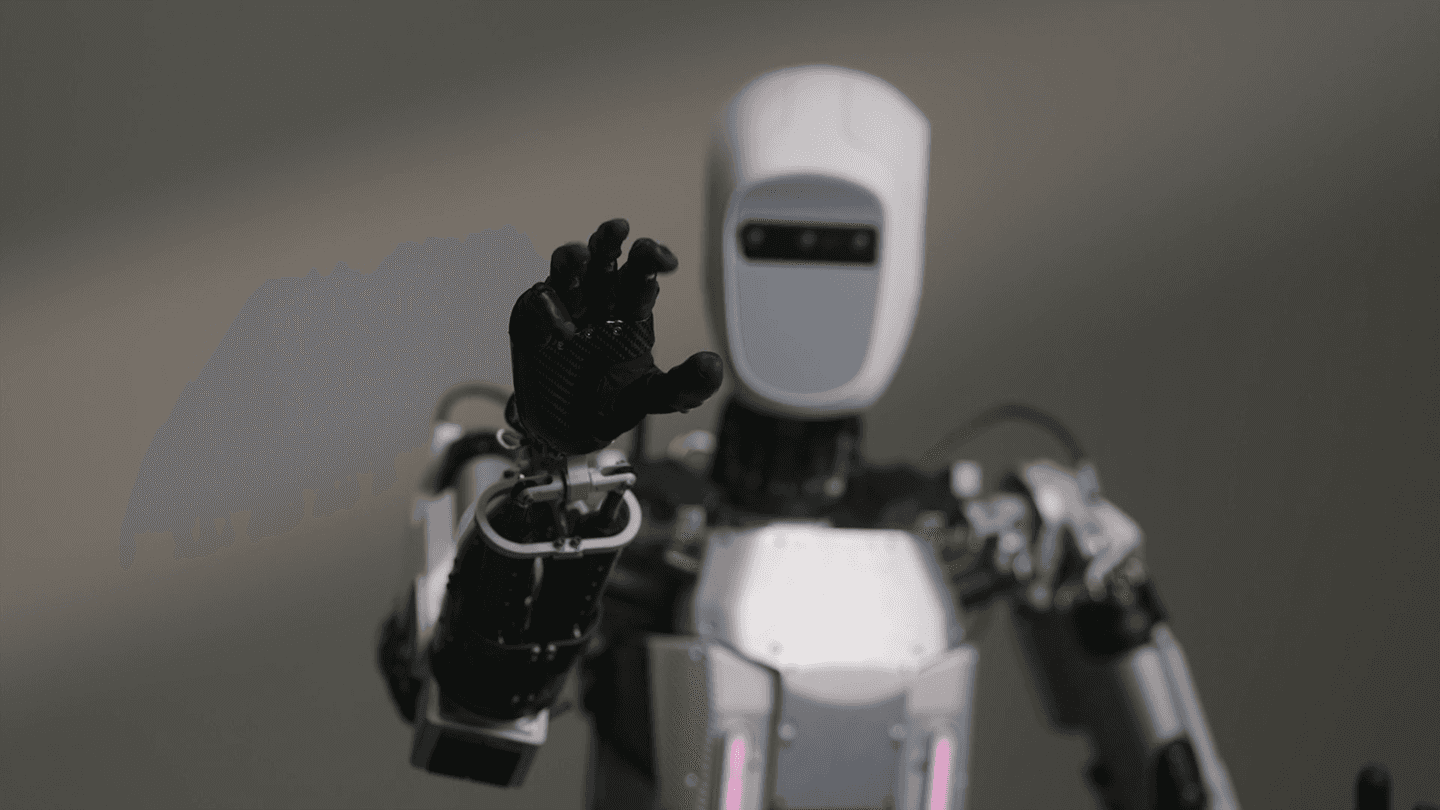

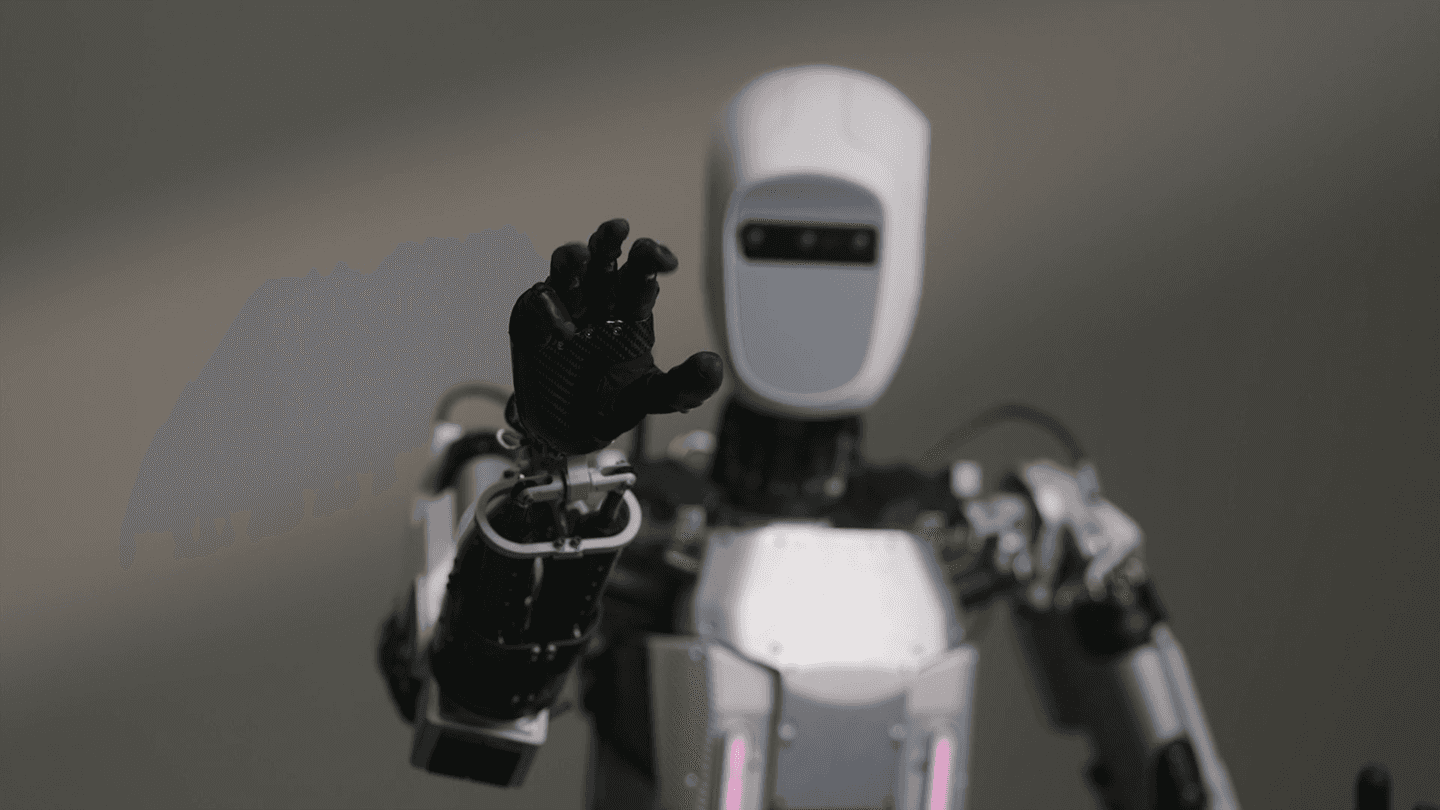

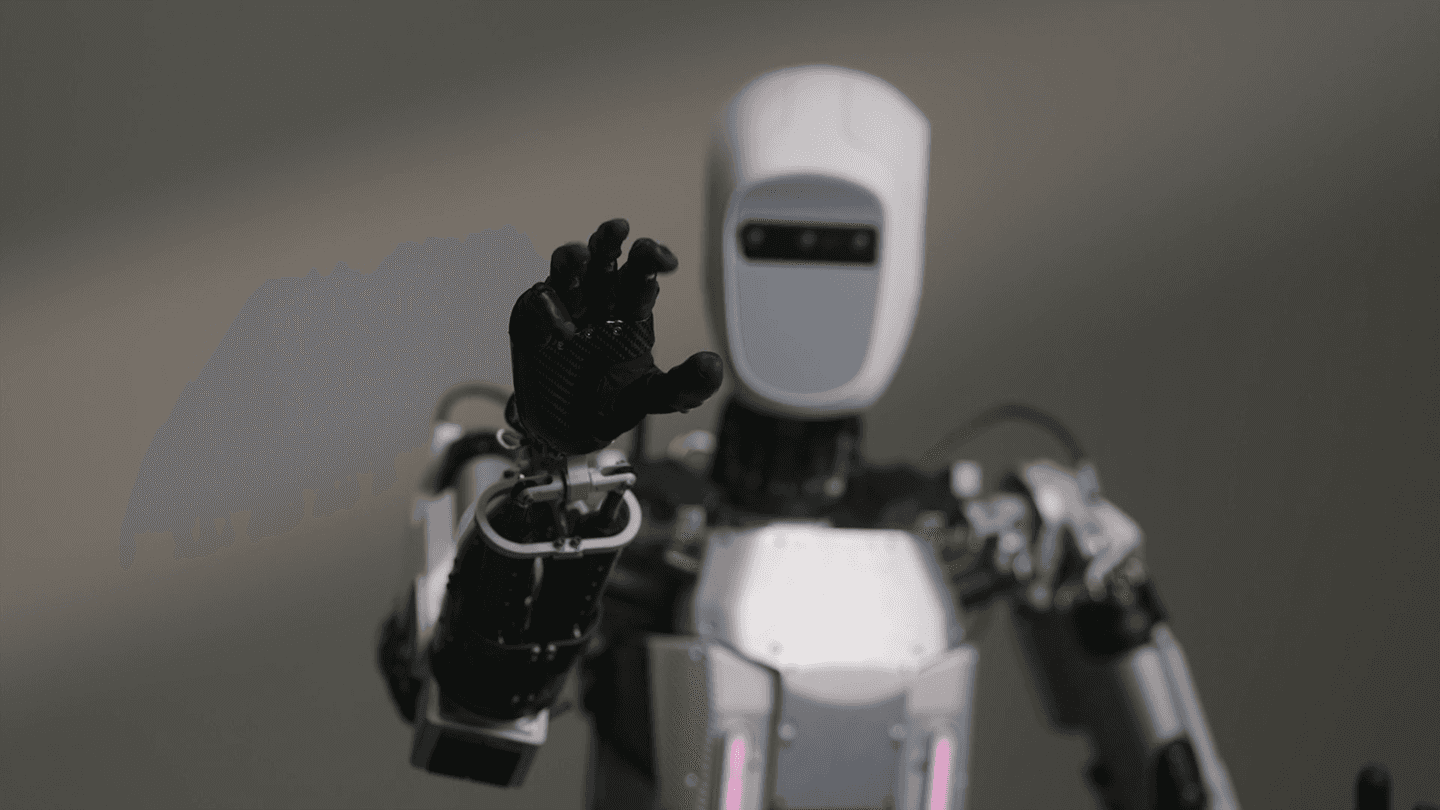

APPTRONIK

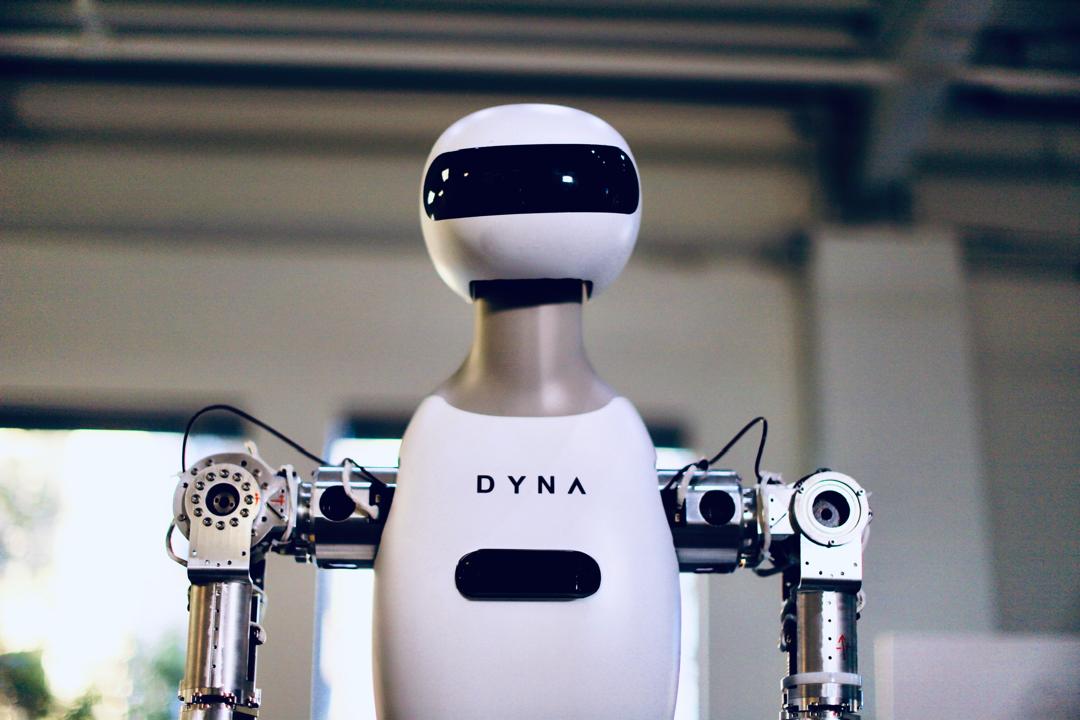

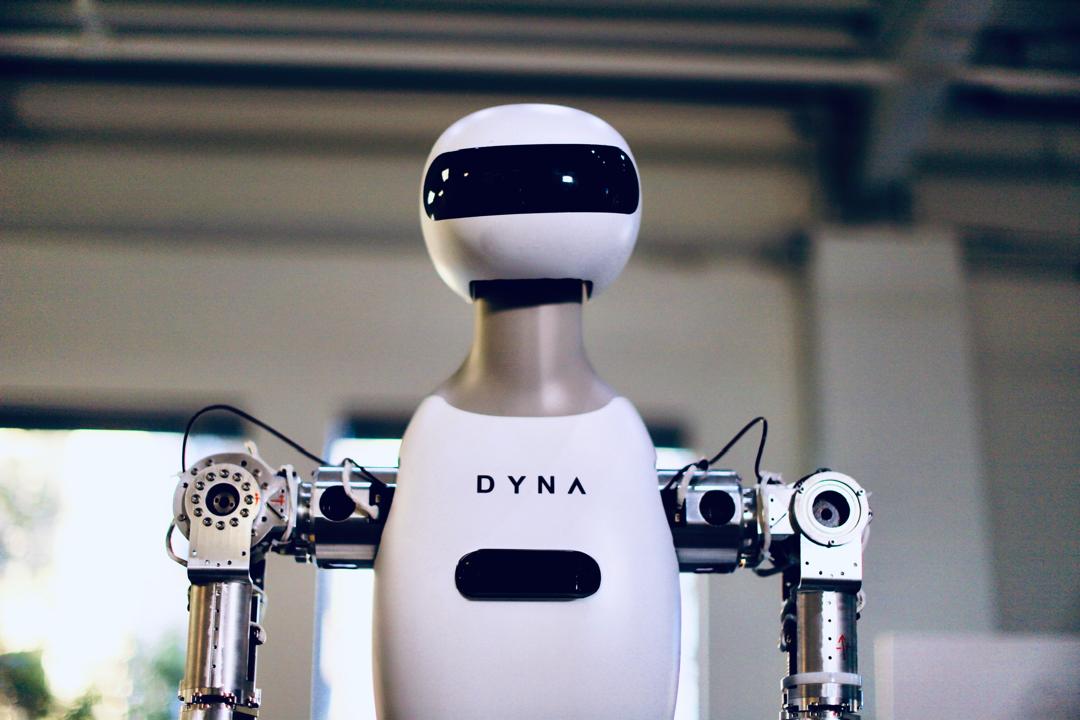

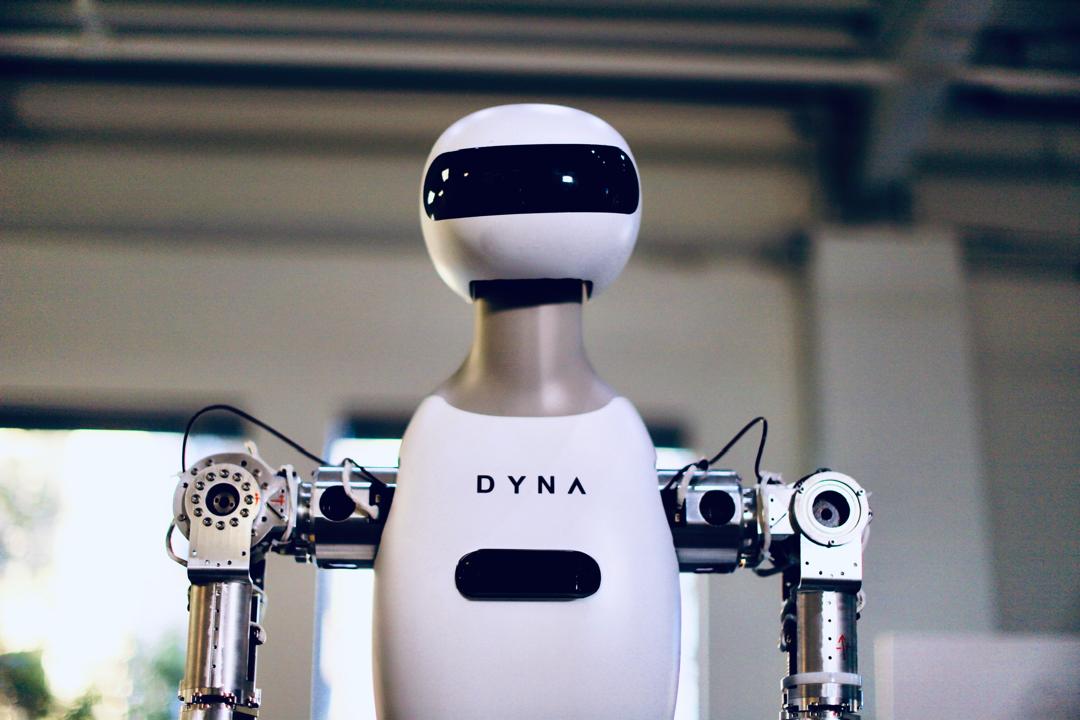

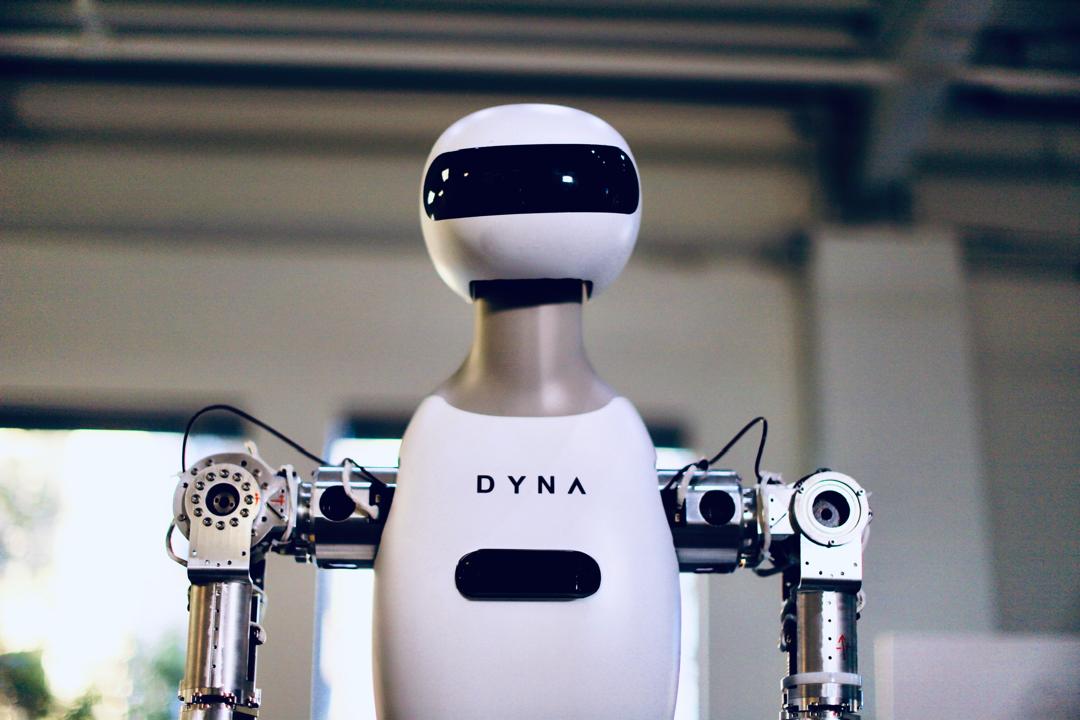

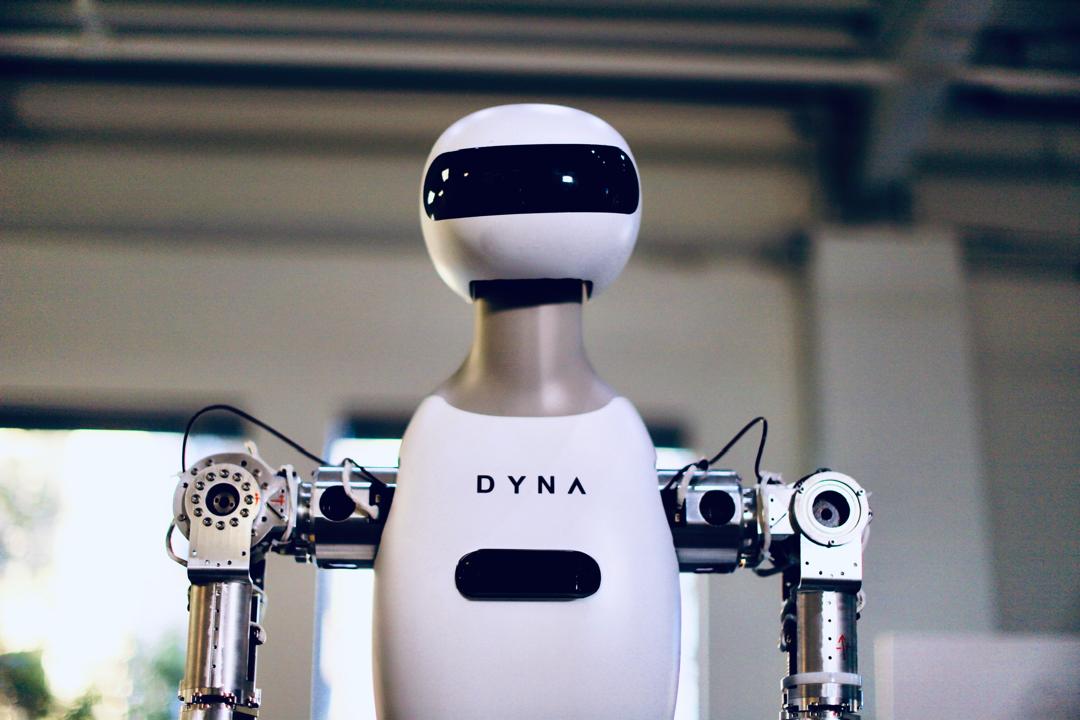

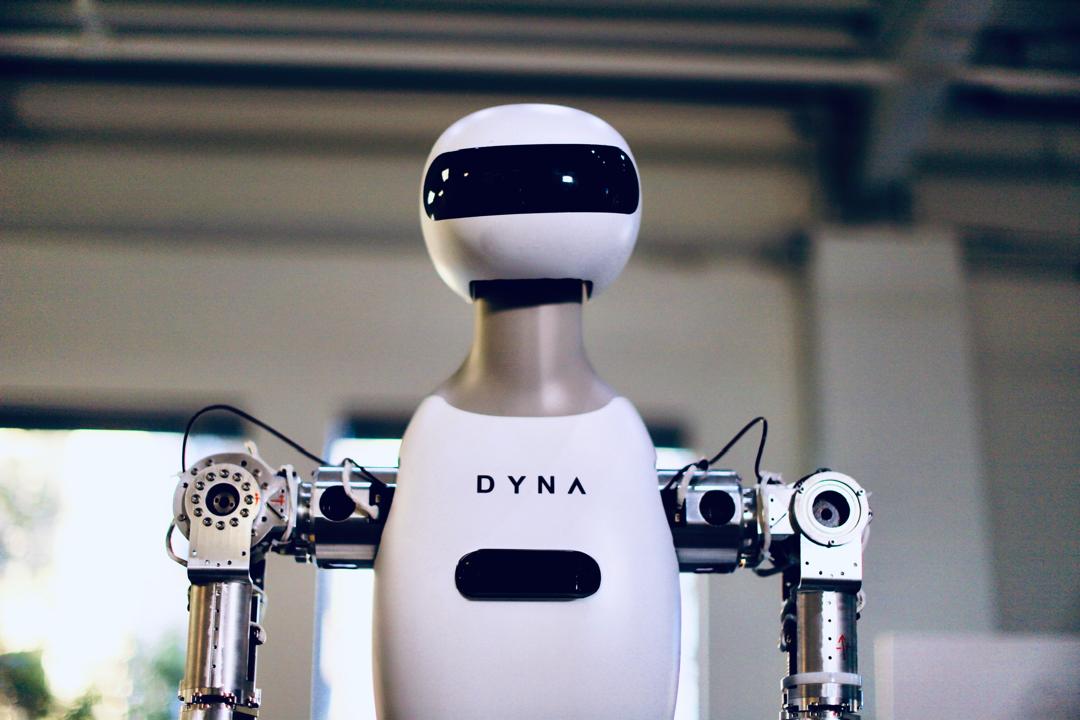

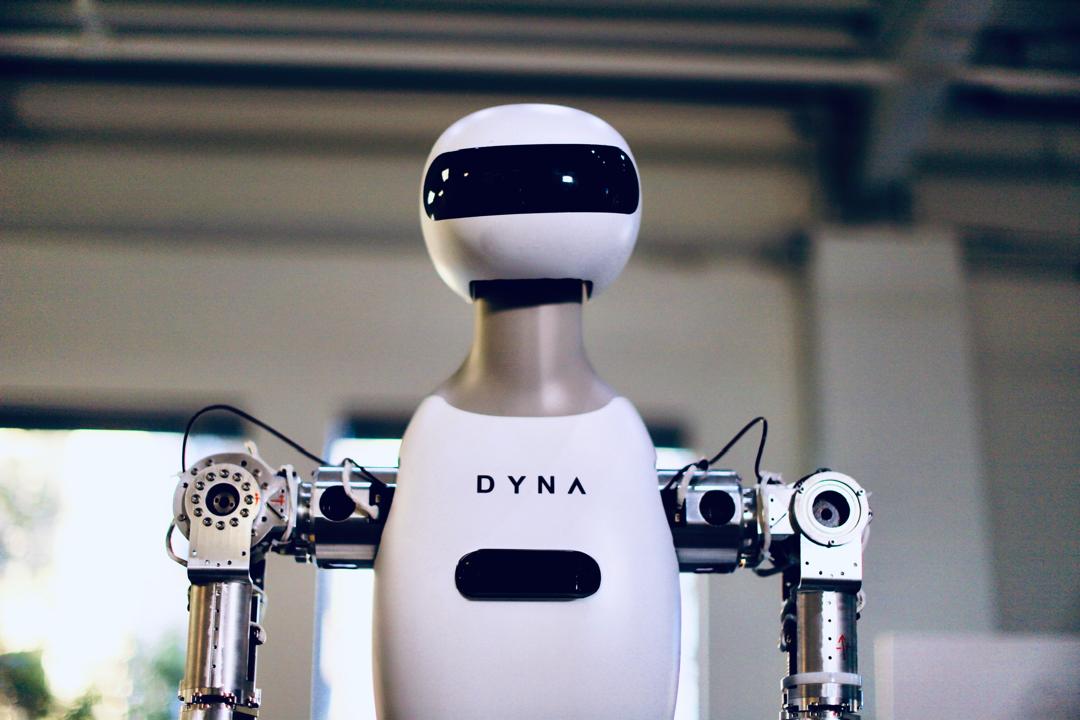

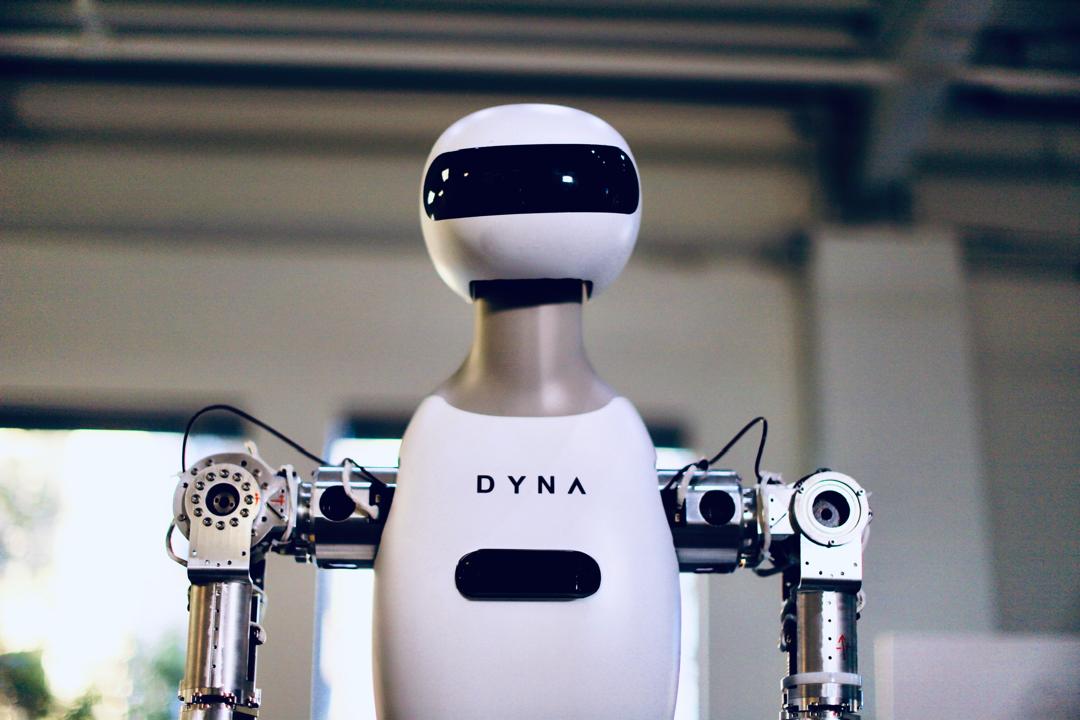

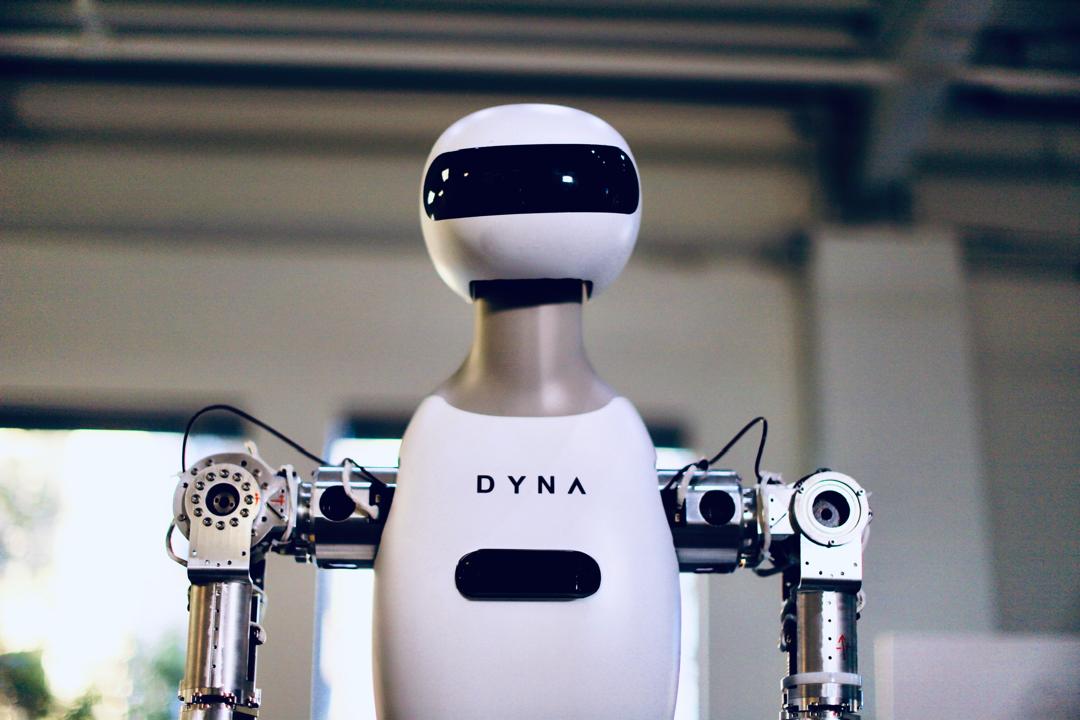

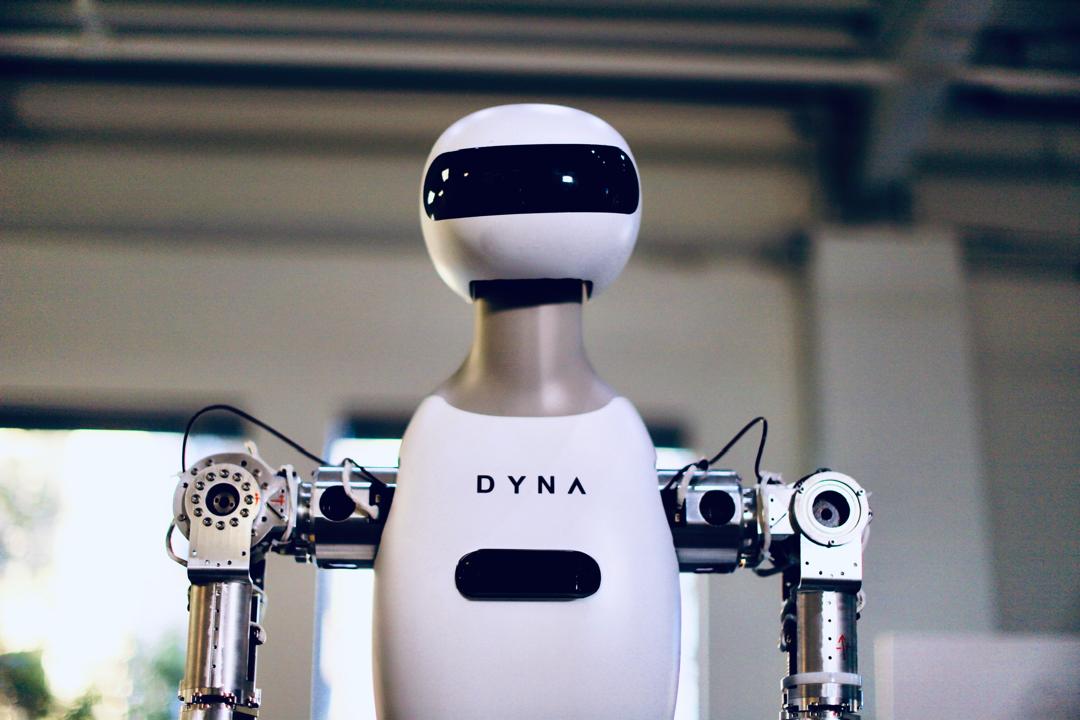

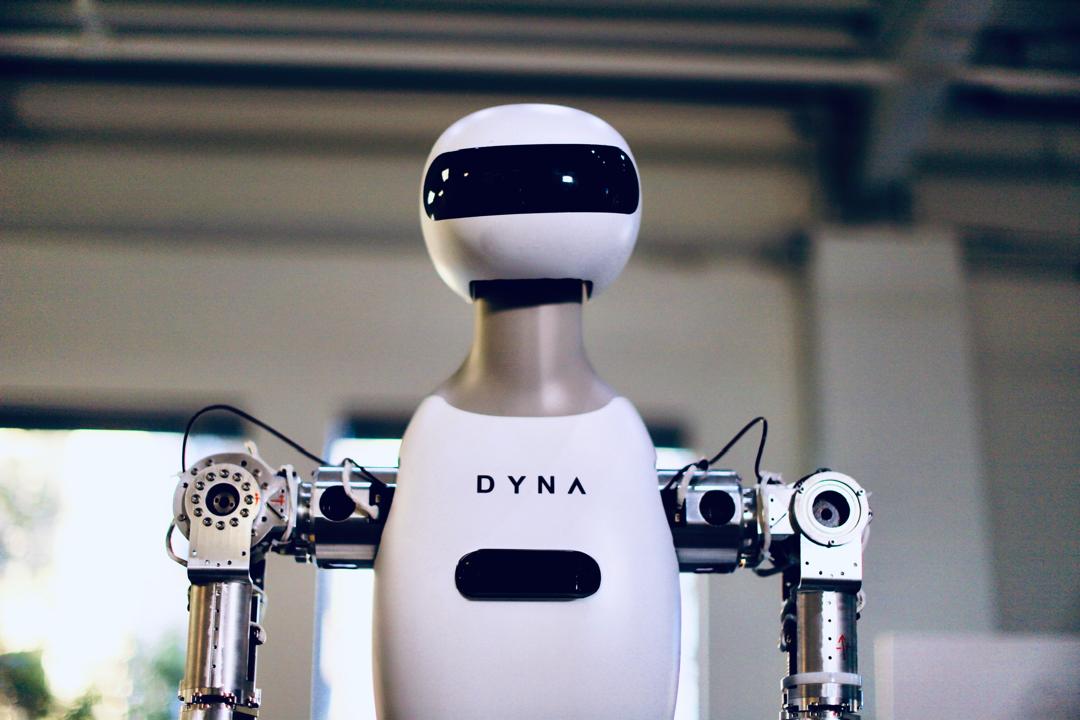

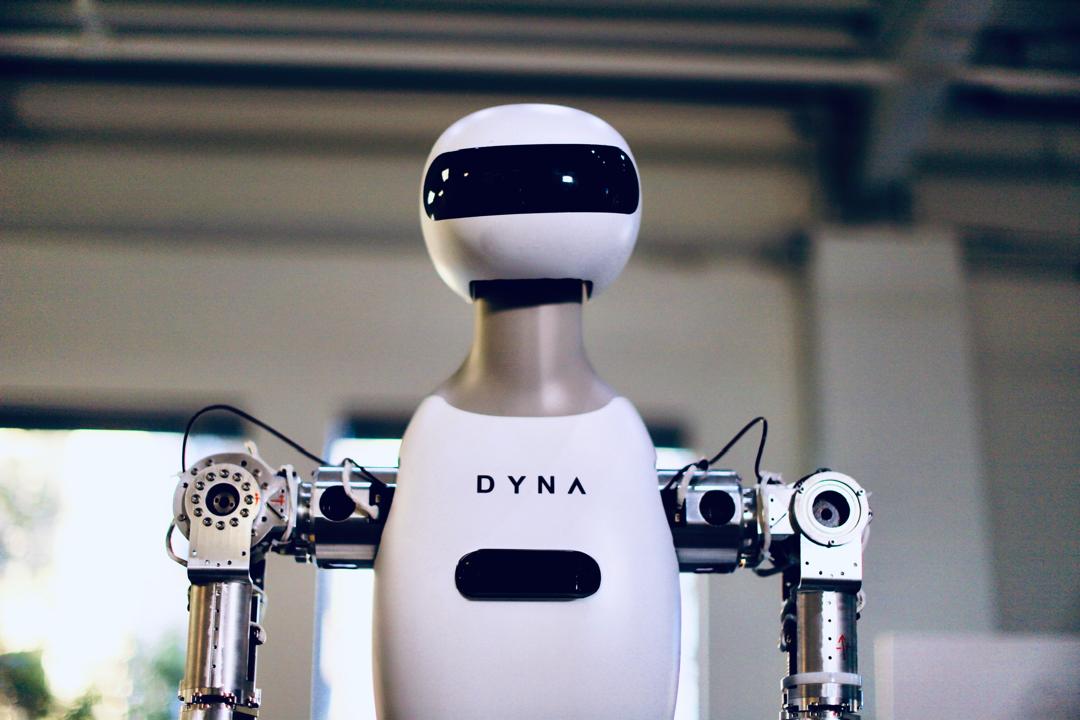

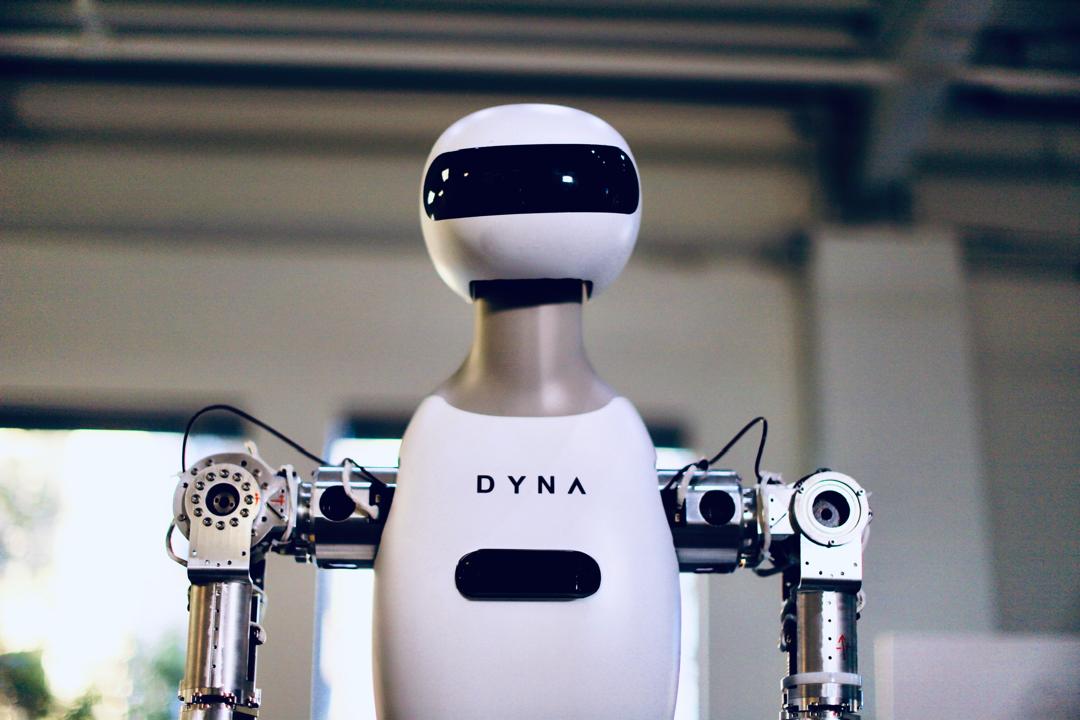

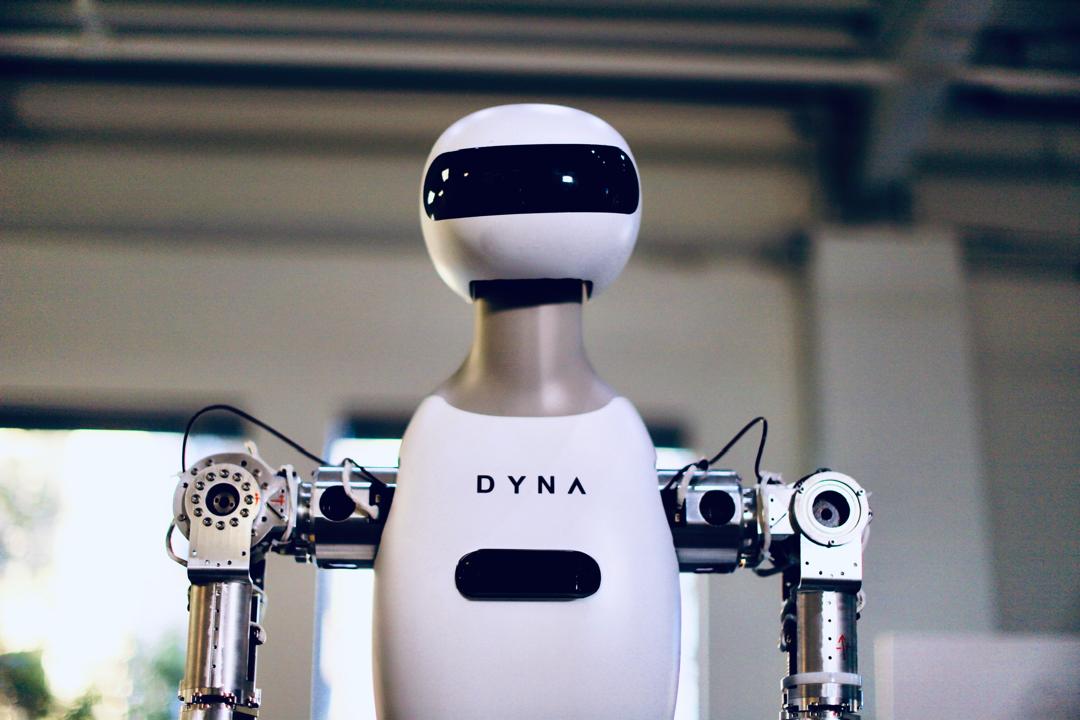

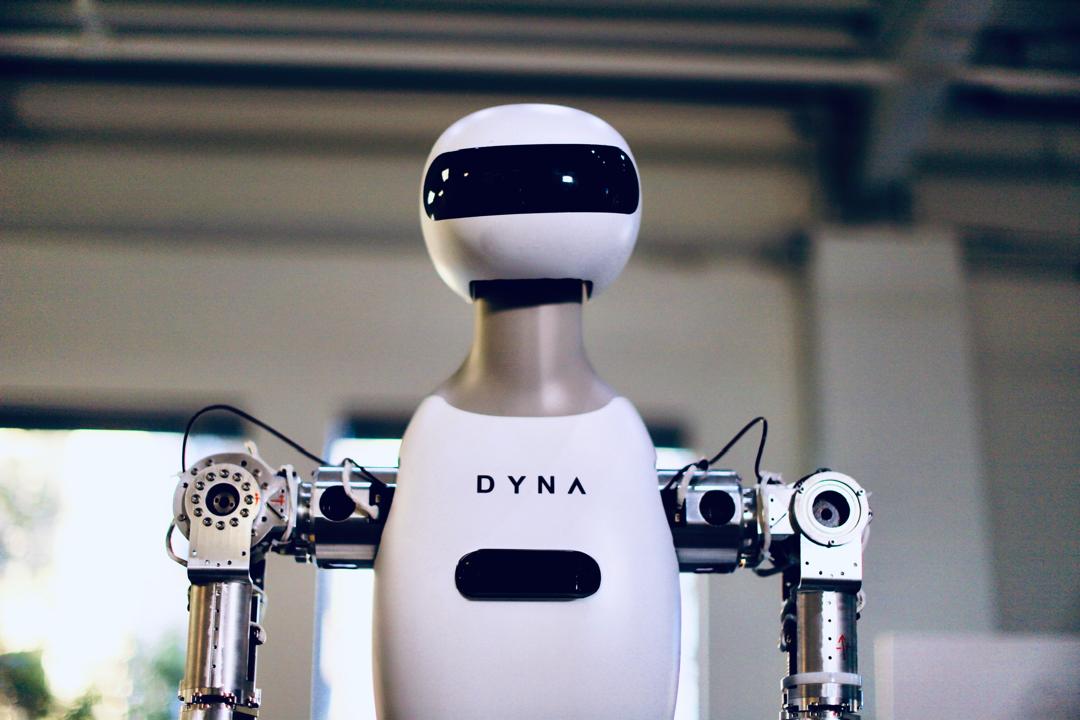

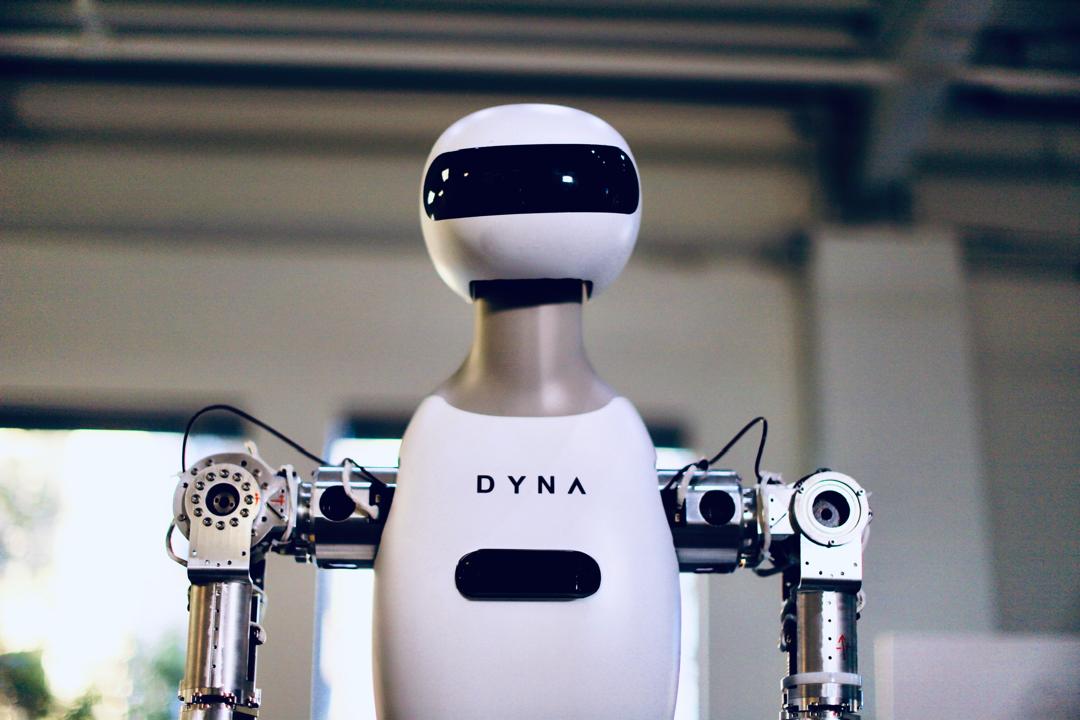

DYNA

FIGURE

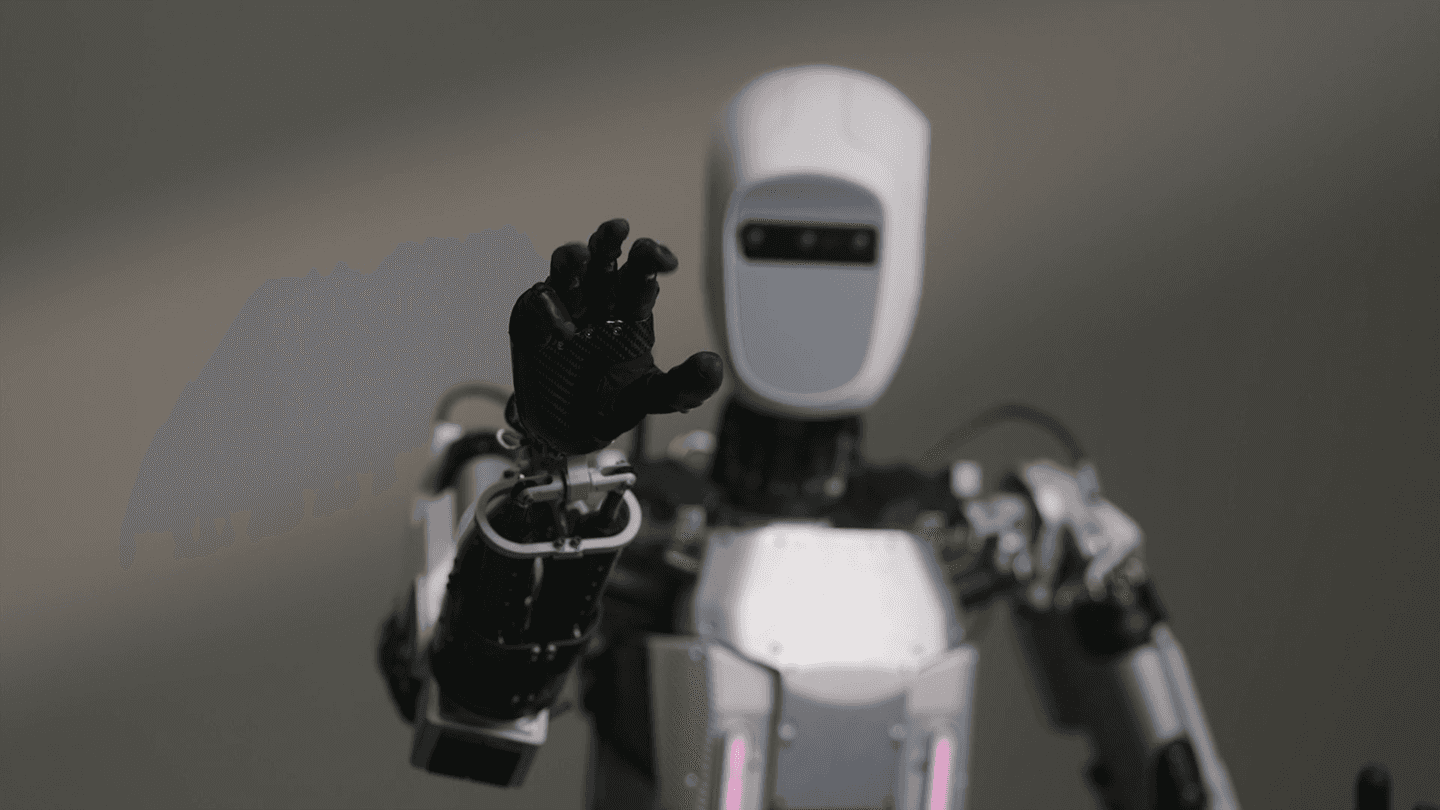

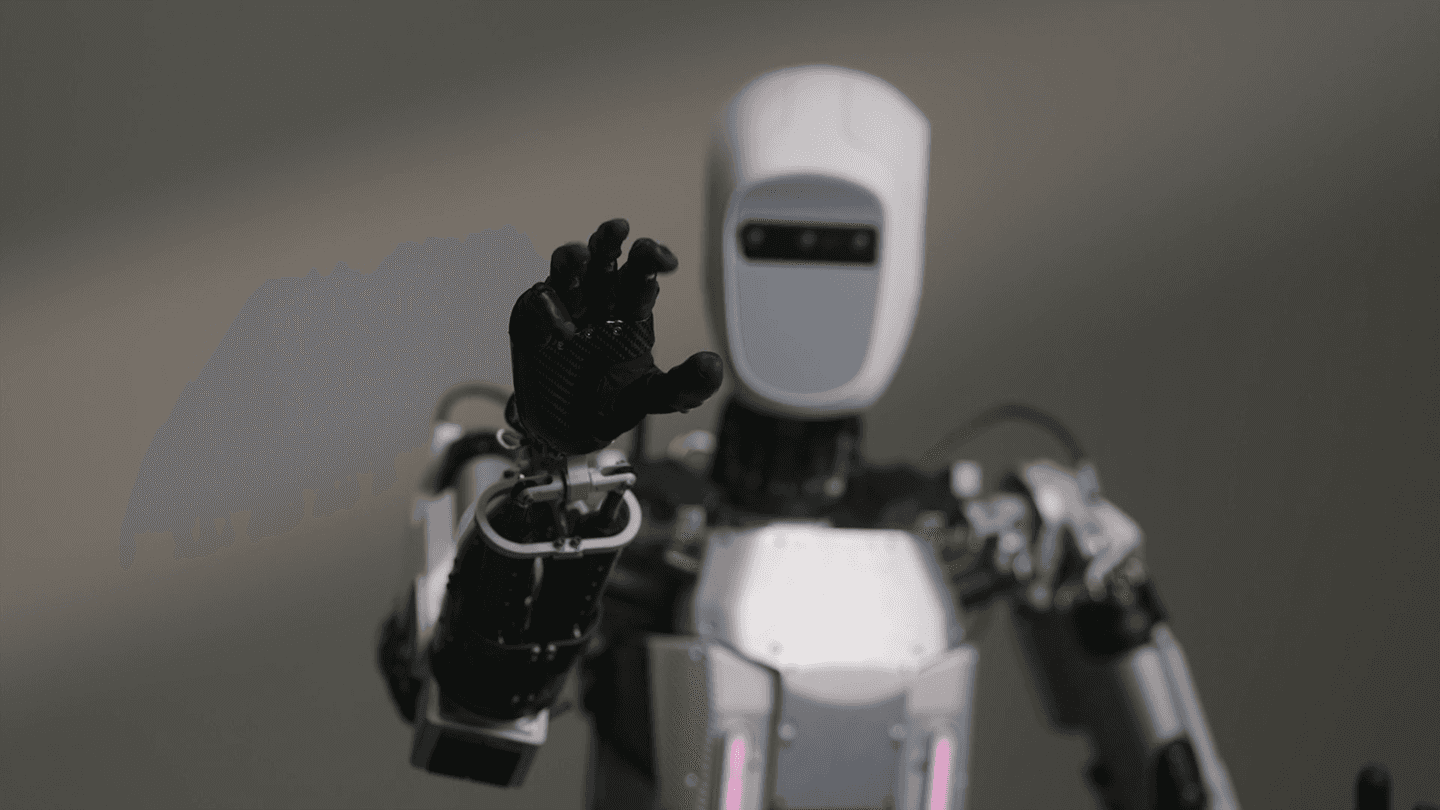

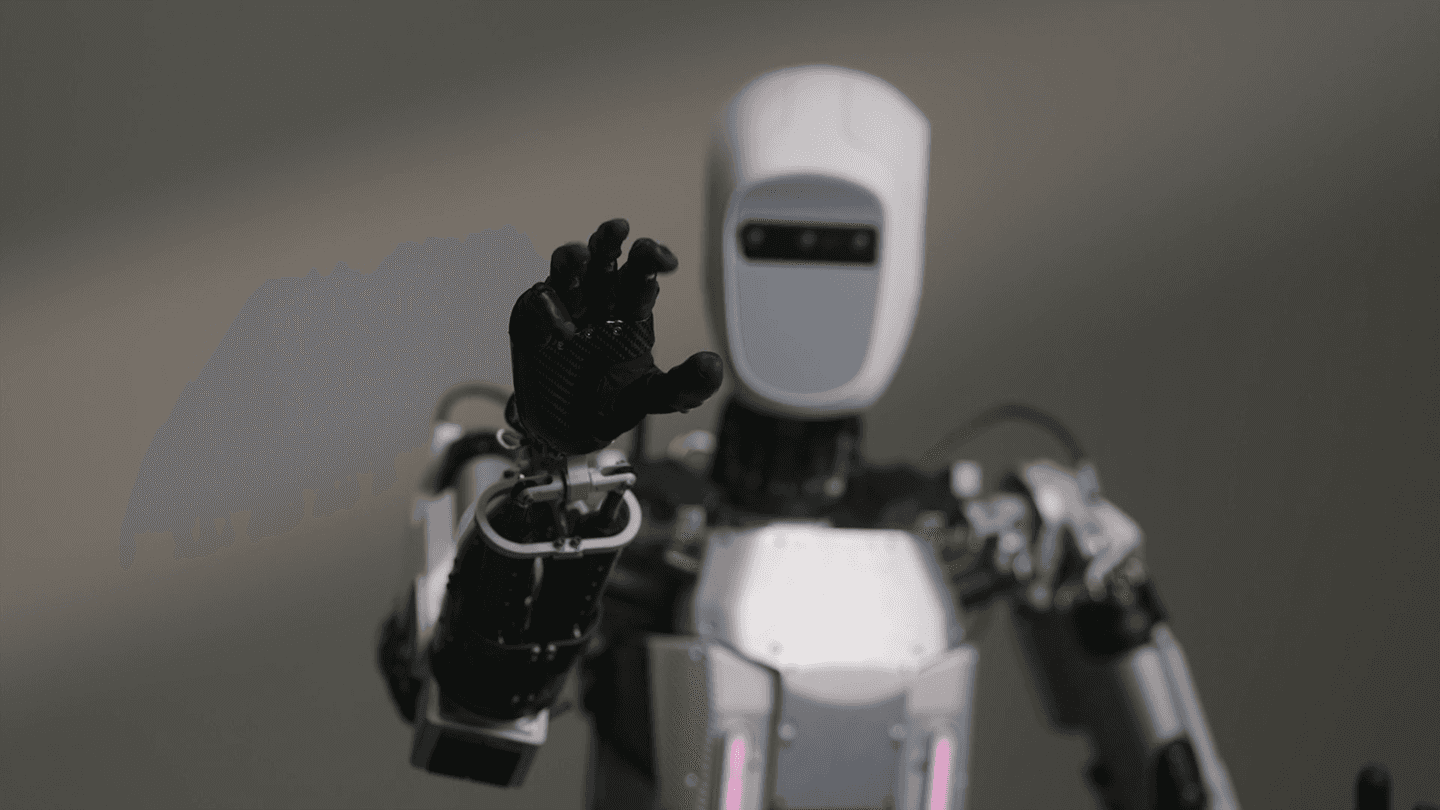

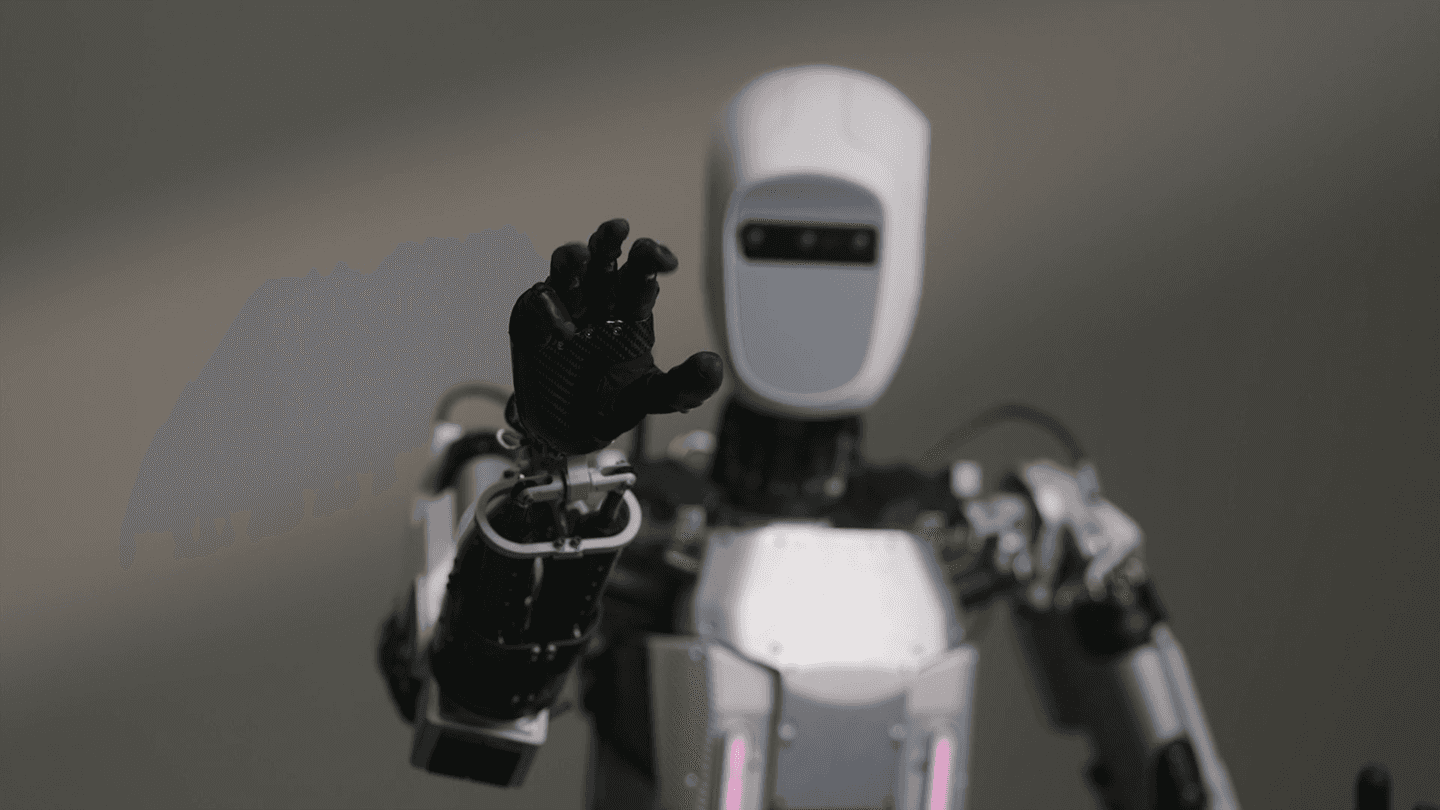

APPTRONIK

DYNA

FIGURE

APPTRONIK

DYNA

FIGURE

APPTRONIK

DYNA

About ROBOSTRATEGY

RoboStrategy invests in leading robotics companies across both private markets and public markets - capturing the rise of embodied AI.

Designed as a closed-end investment vehicle, the fund seeks to combine the growth potential of venture capital with the liquidity and transparency typically associated with public markets.

Robostrategy aims to offer public market investors direct exposure to the most important companies in embodied AI and robotics.

PORTFOLIO

Targeting the Breakout Winners of the Robotics Revolution

Category Leader in Full-Stack Humanoid Systems

INVESTED

2025

Strategic Google Partnership — Embodied Gemini AI

INVESTED

2025

Building & Commercializing General-Purpose Physical Intelligence

INVESTED

2025

Robotic welding systems for enhanced precision and adaptability.

INVESTED

2025

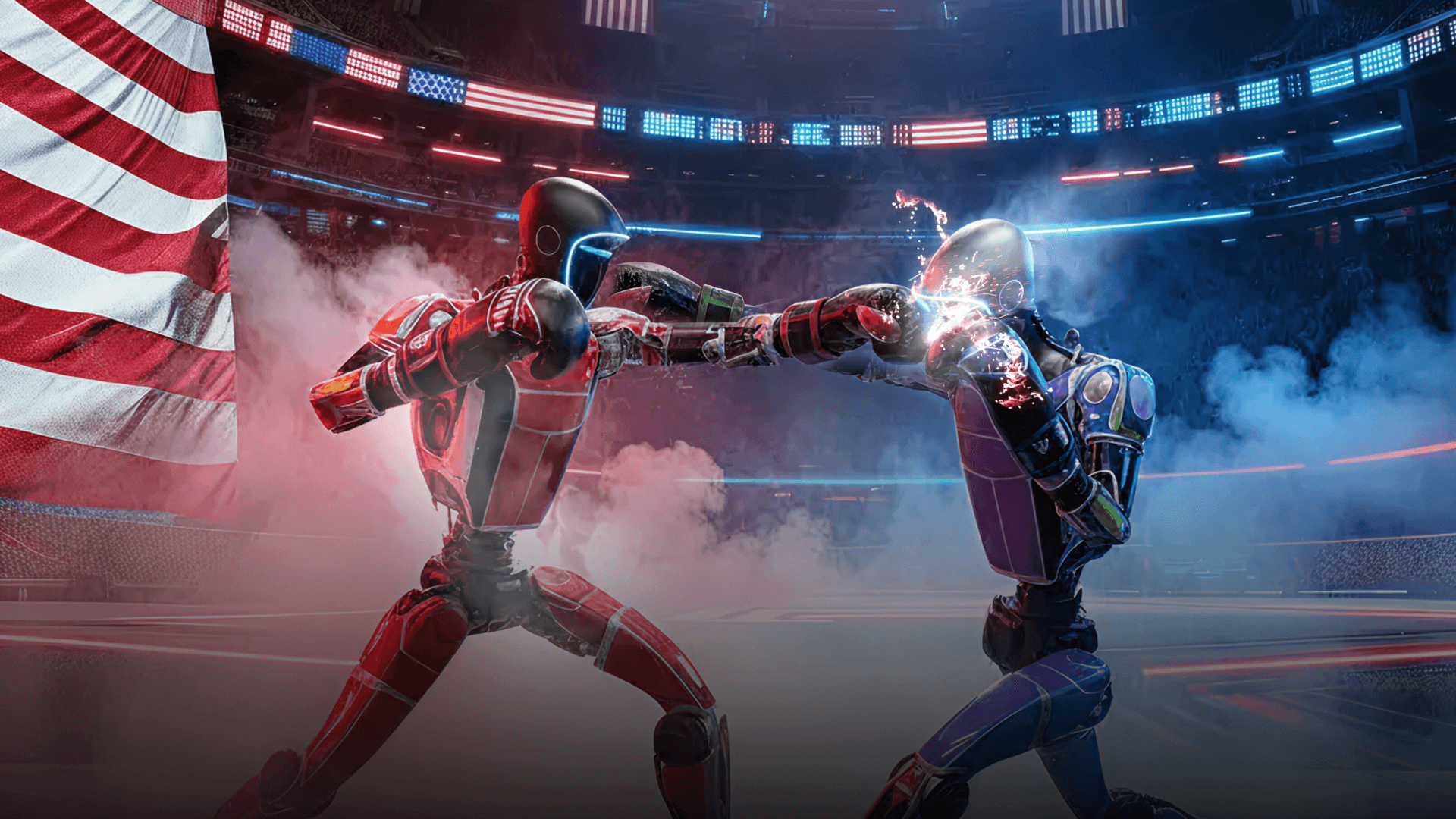

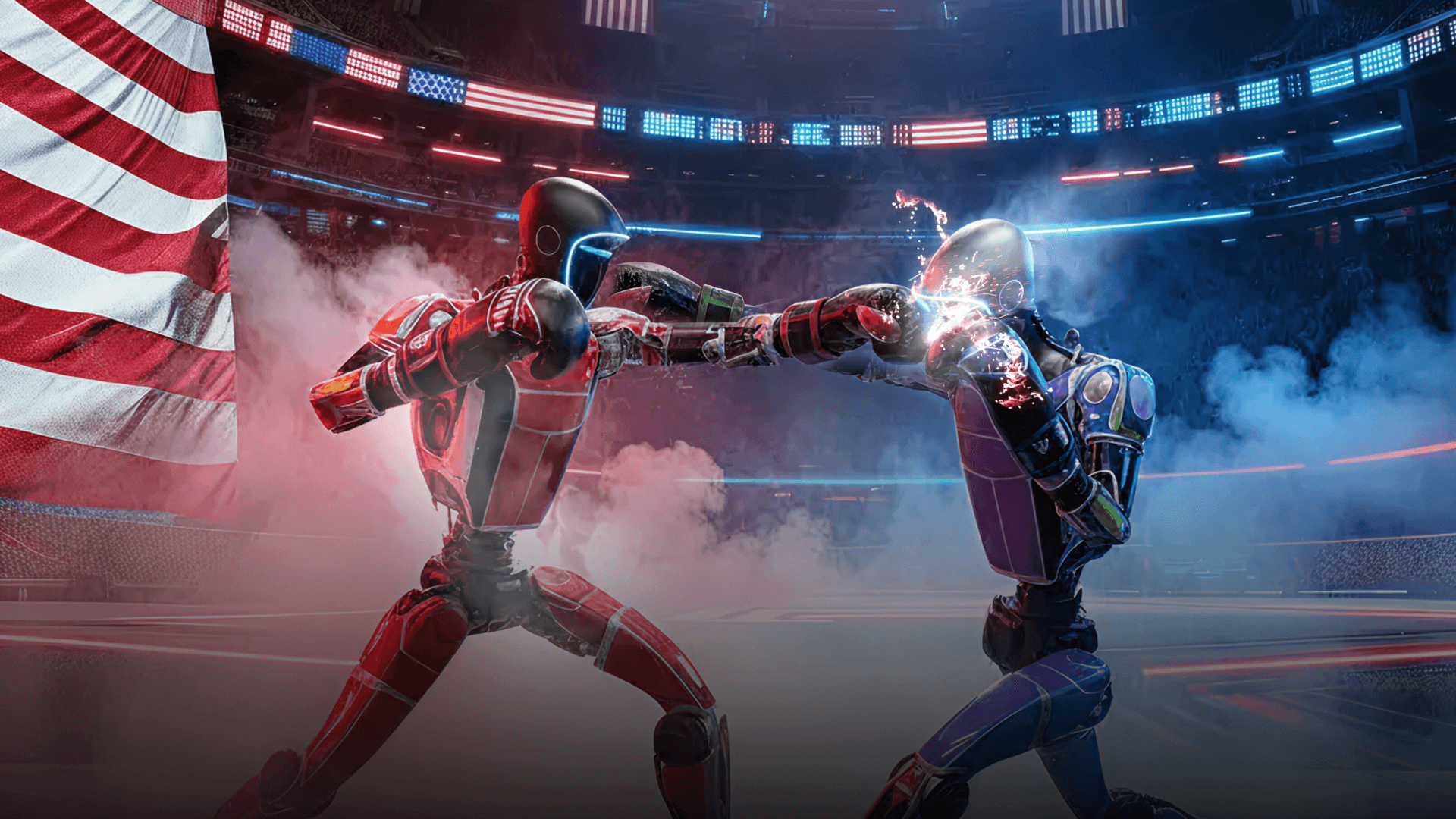

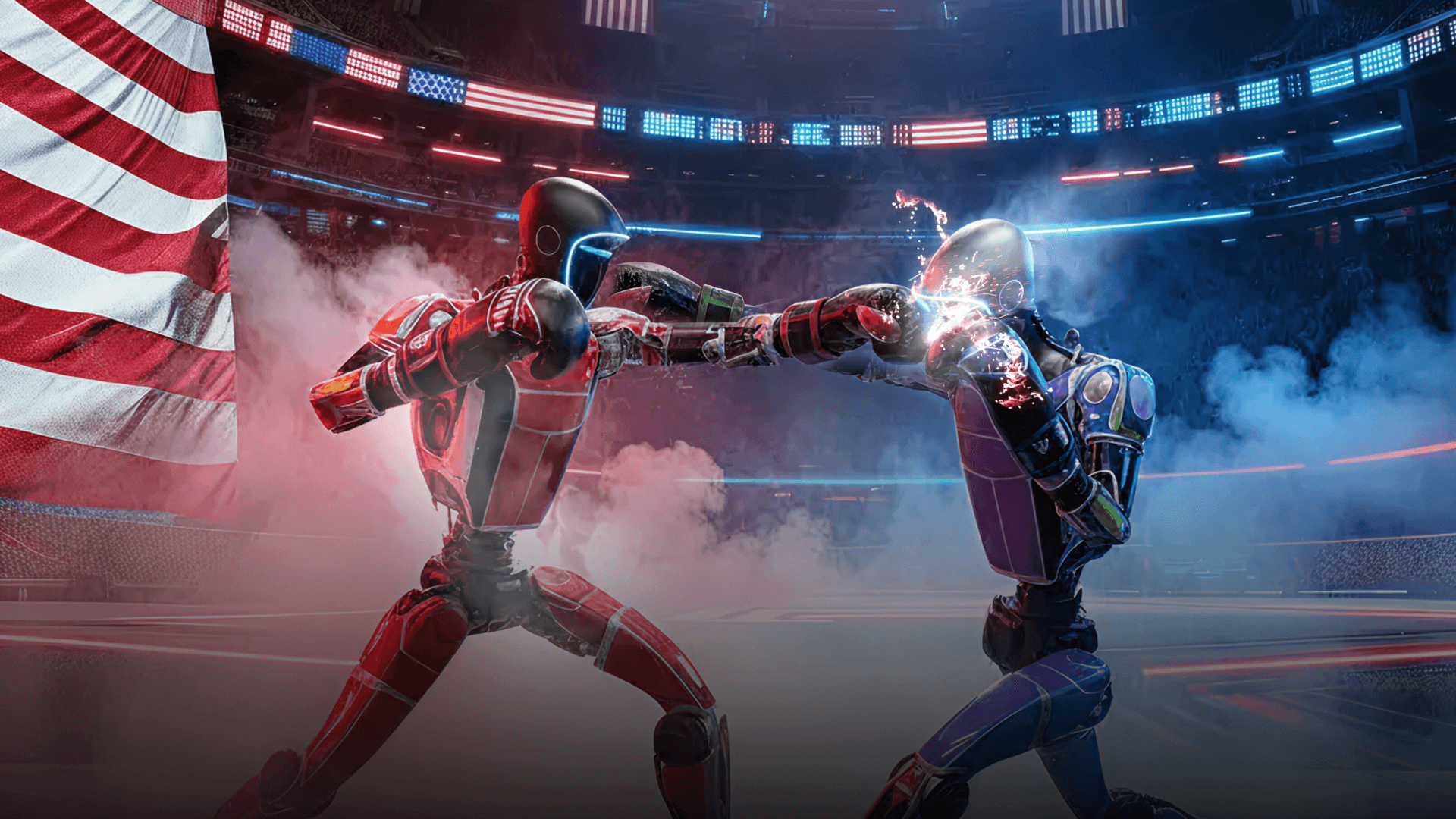

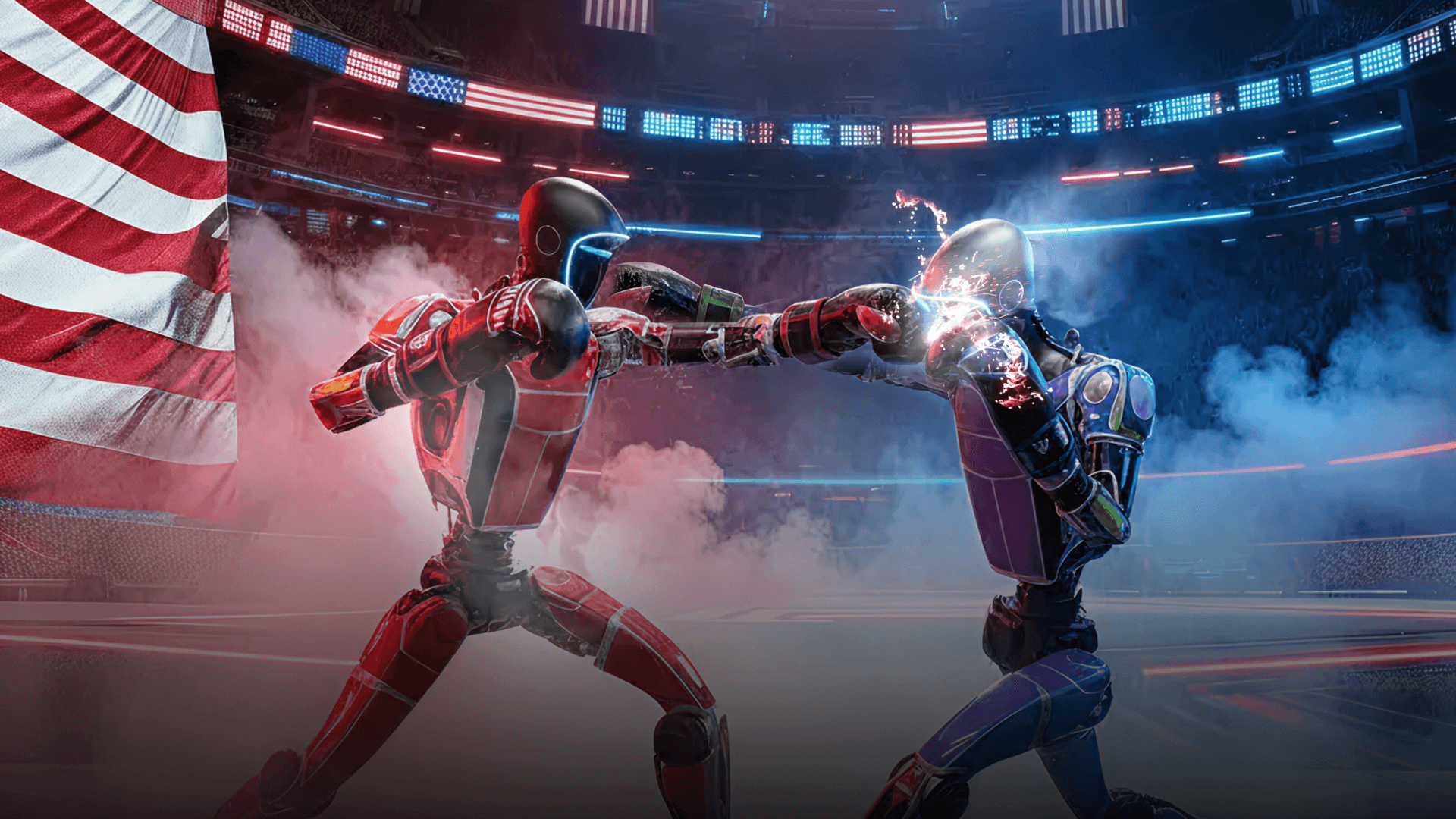

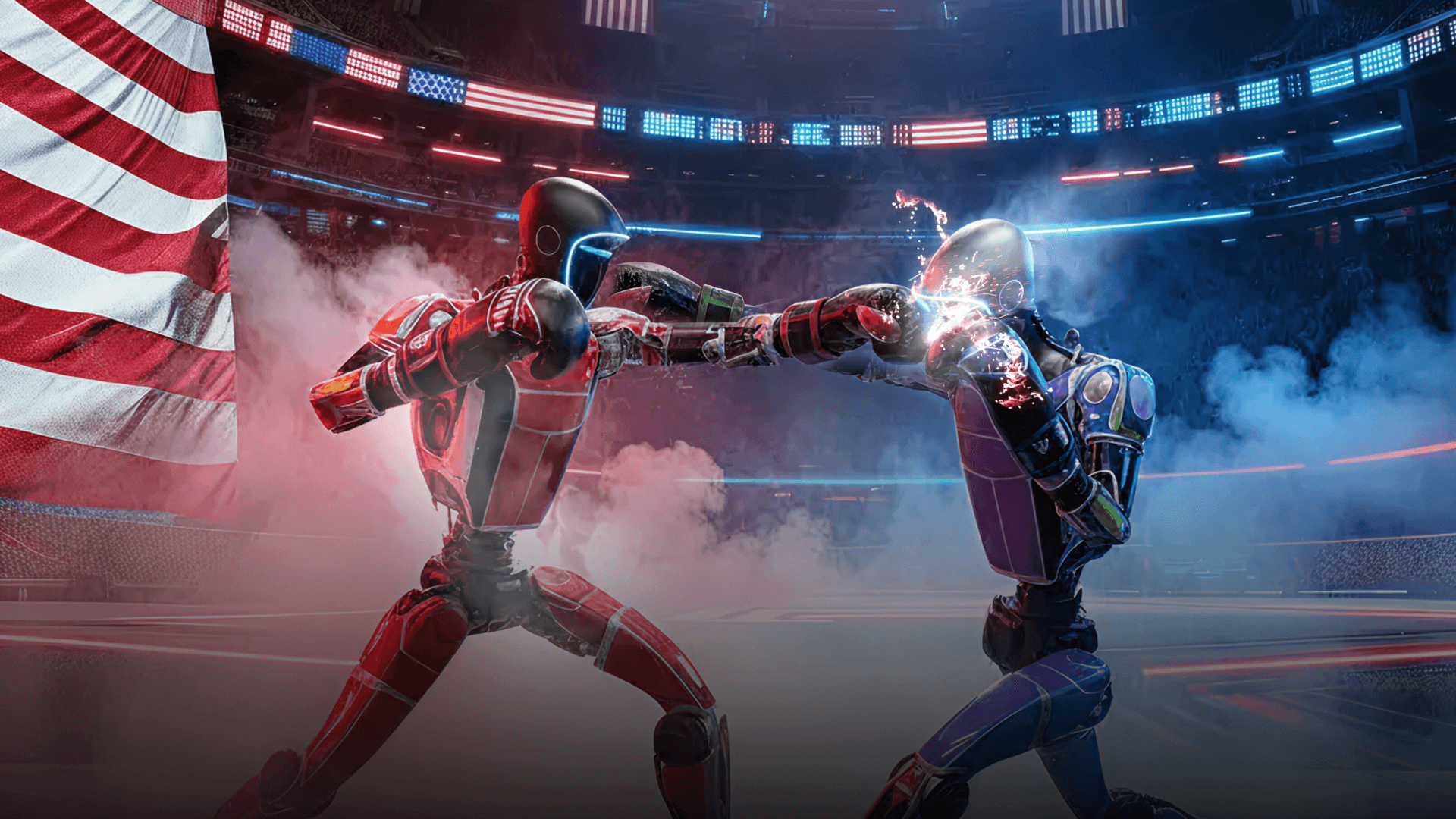

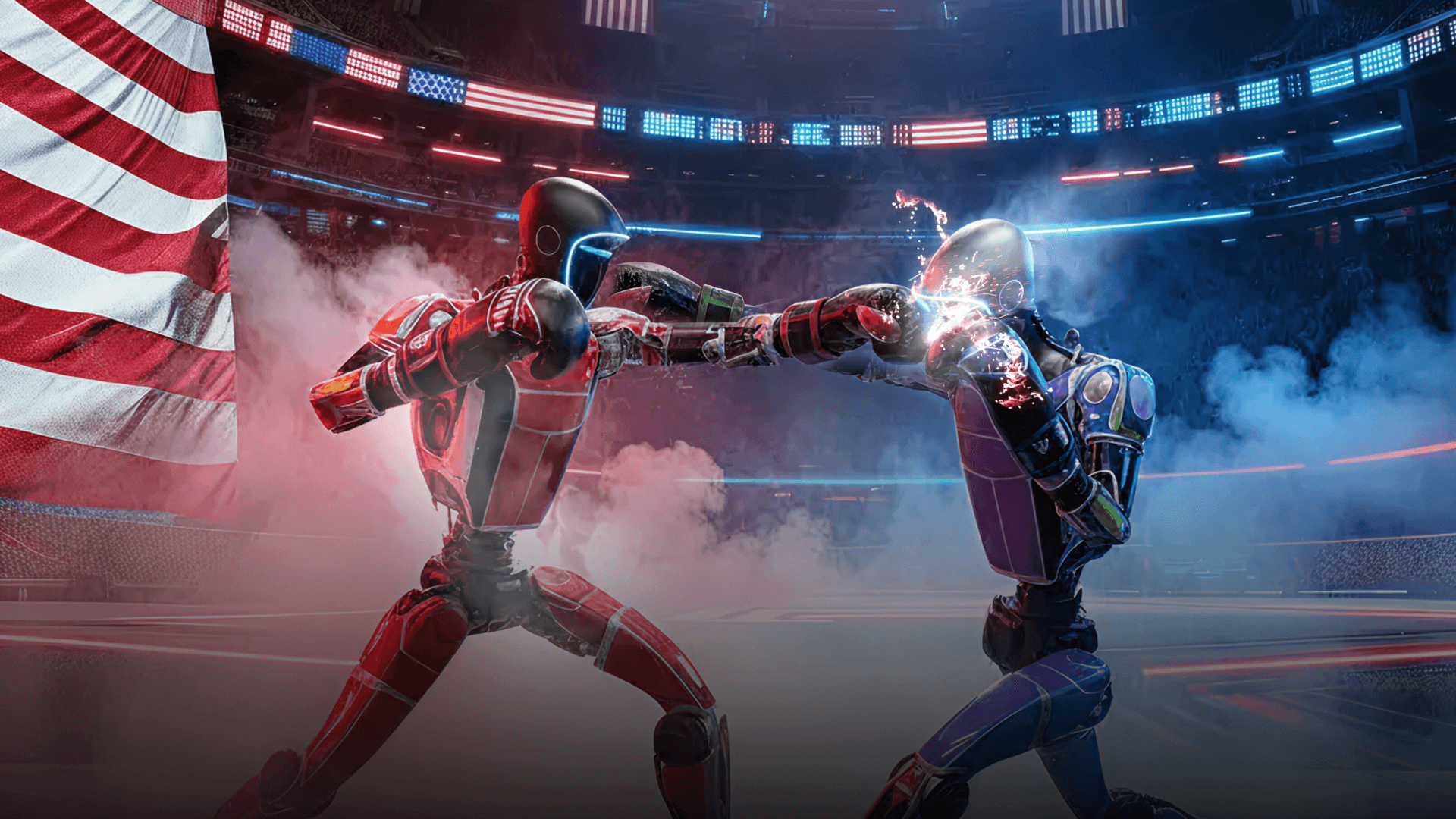

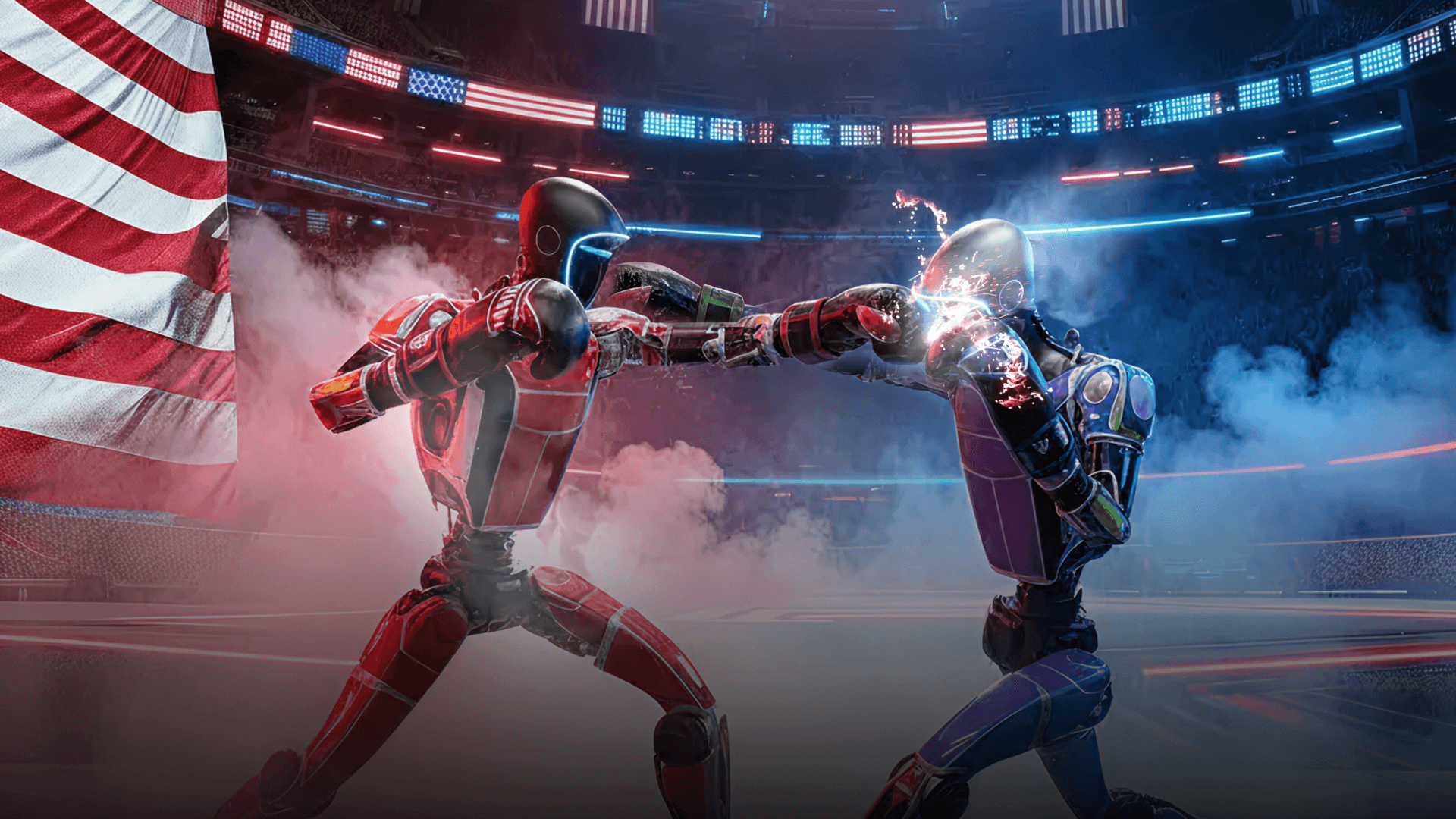

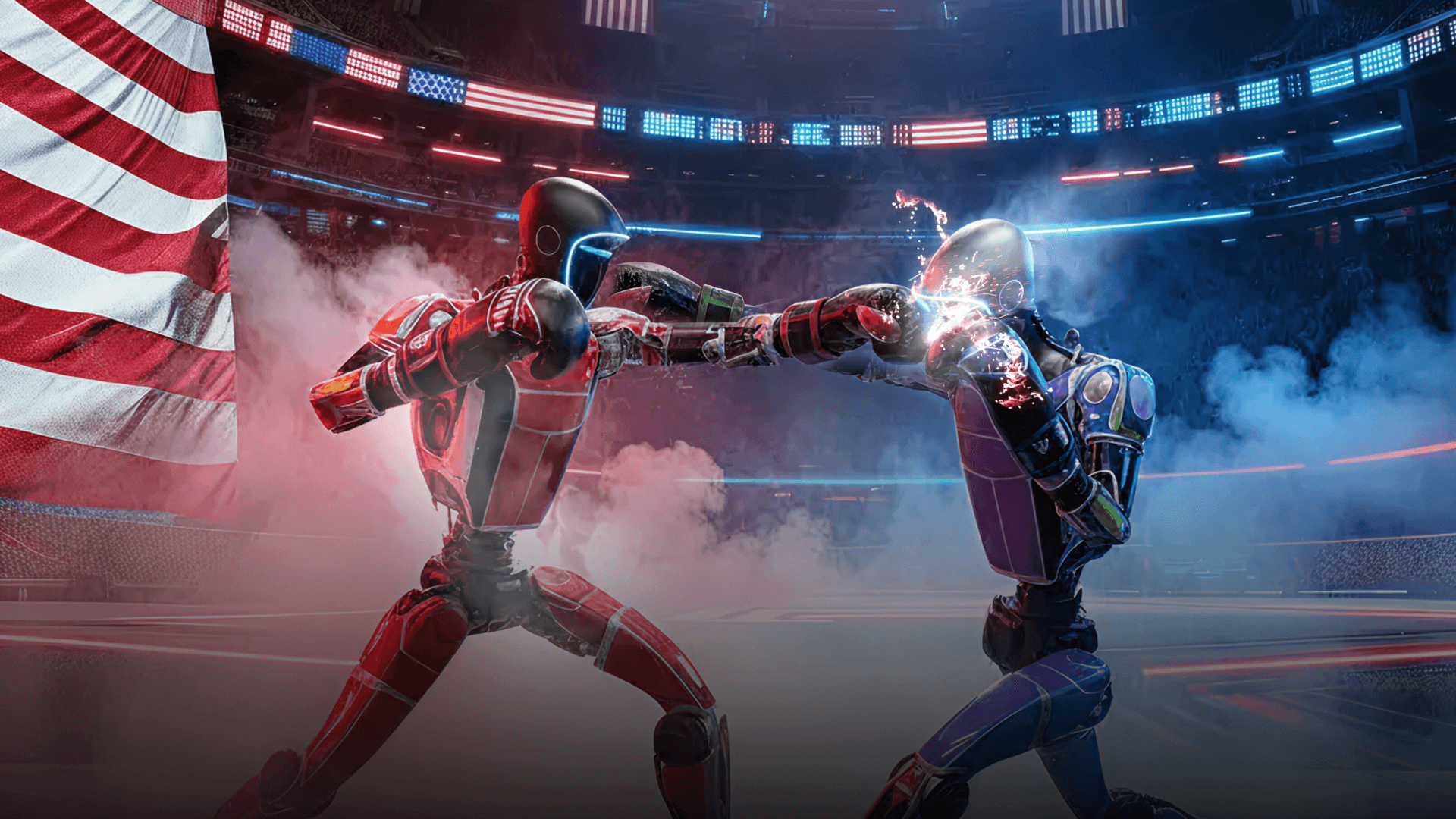

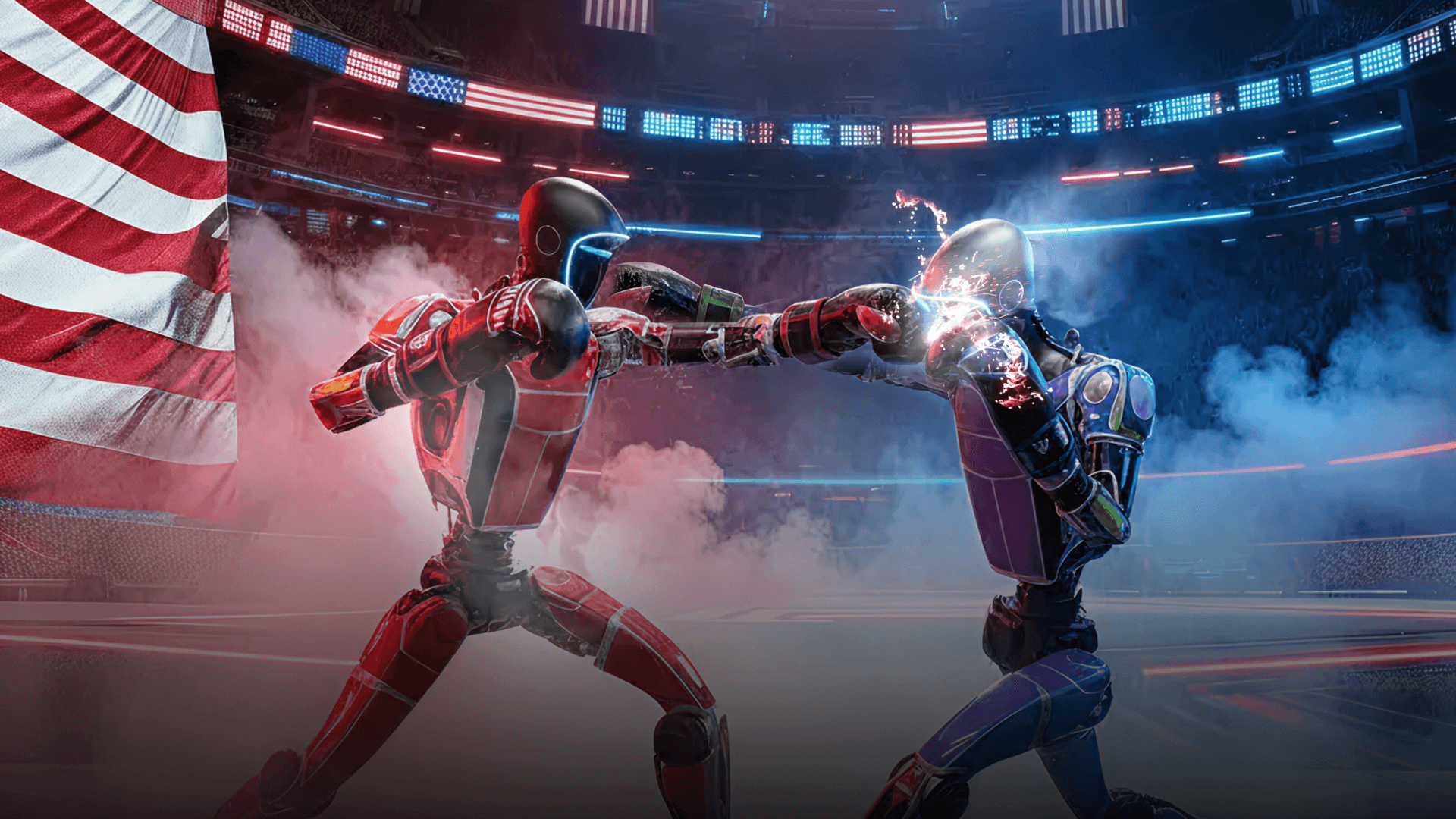

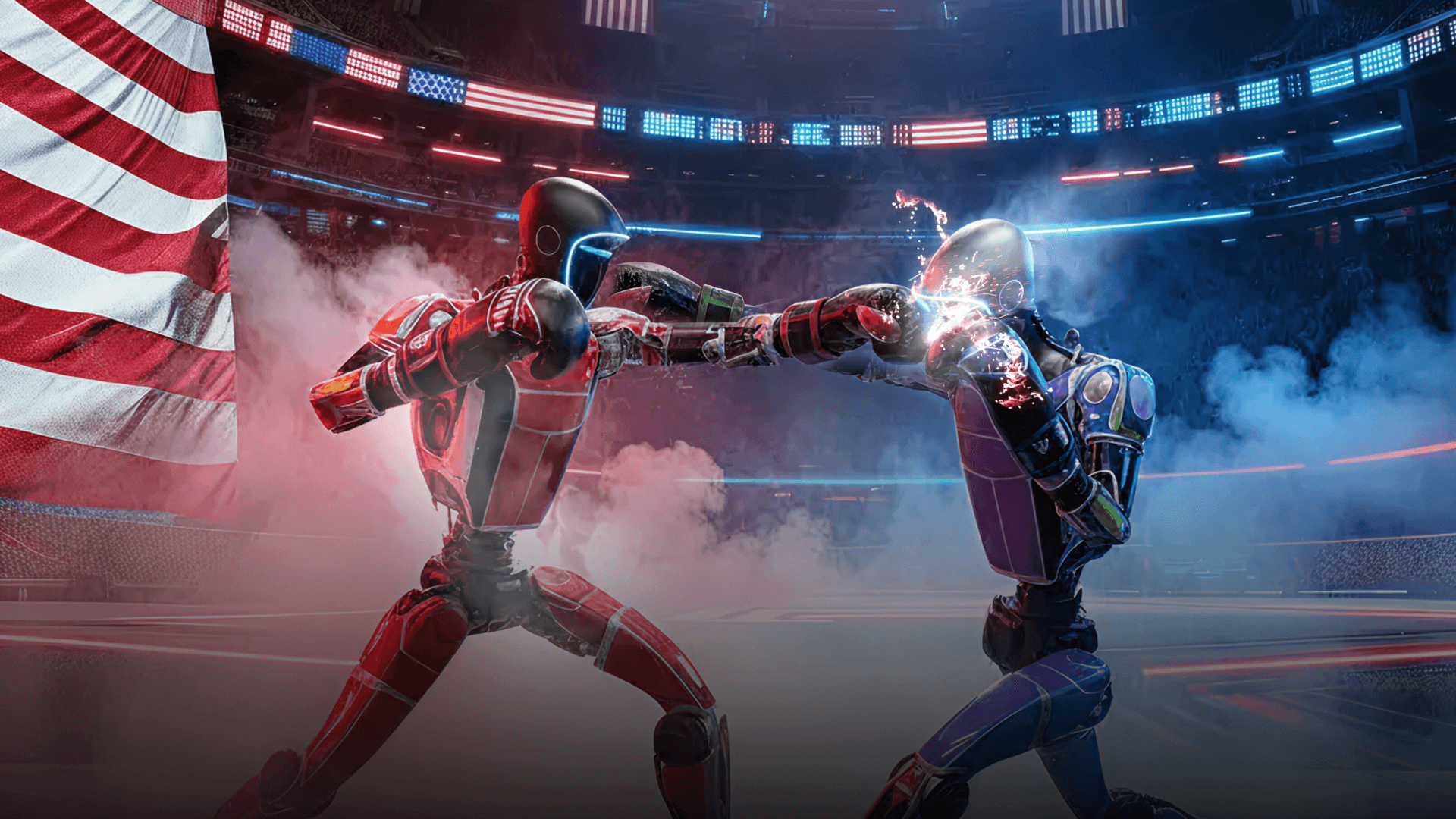

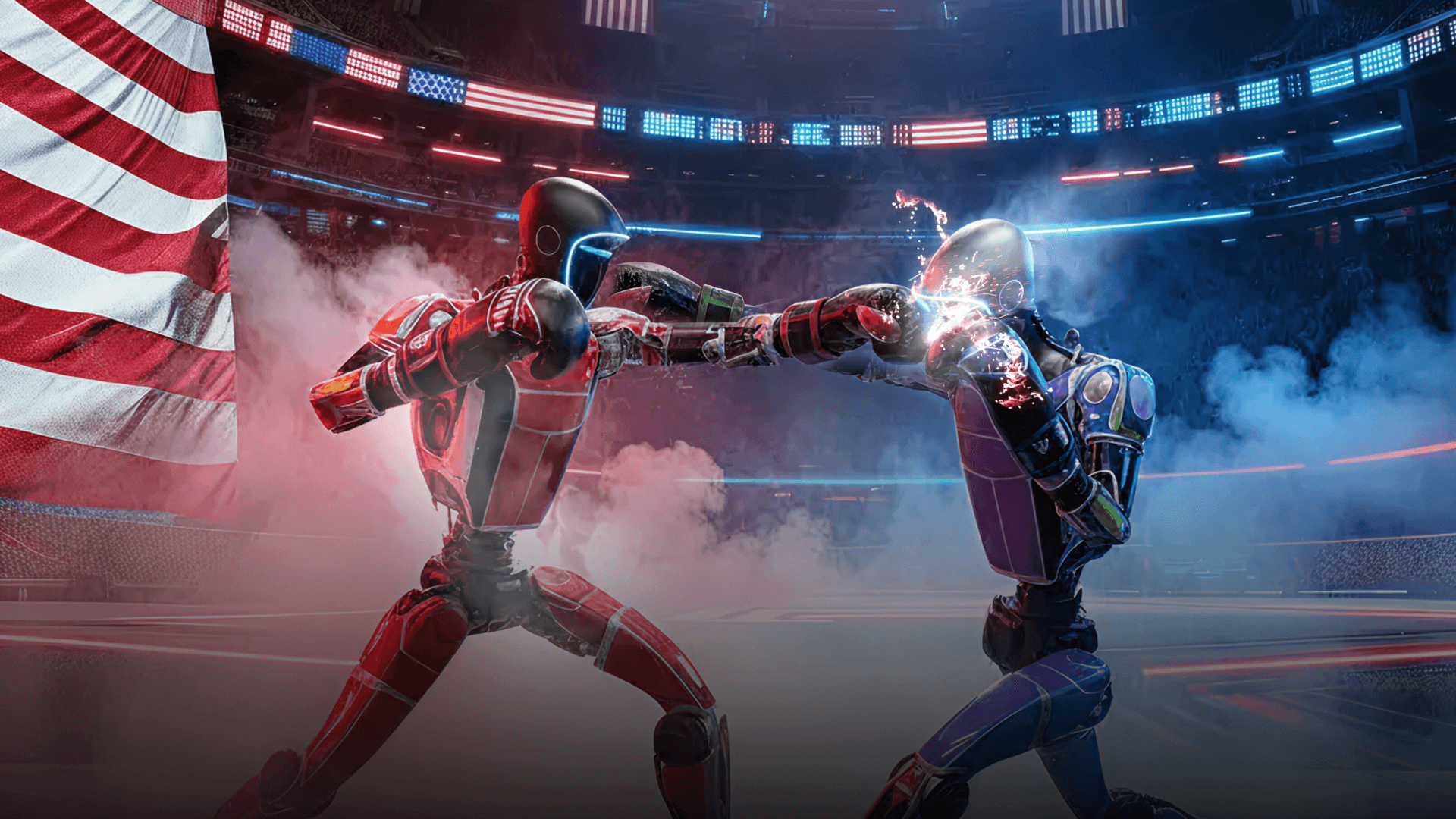

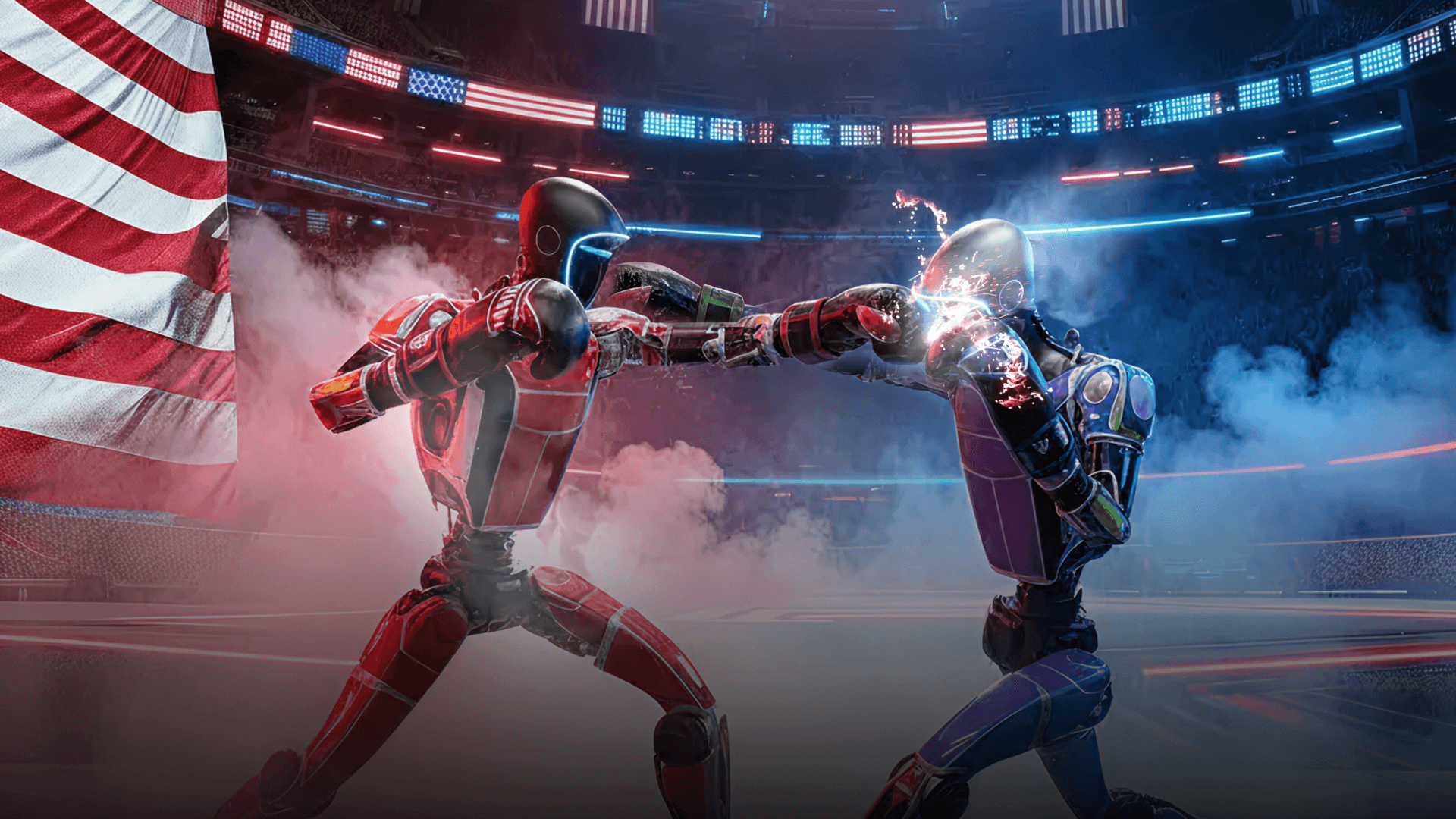

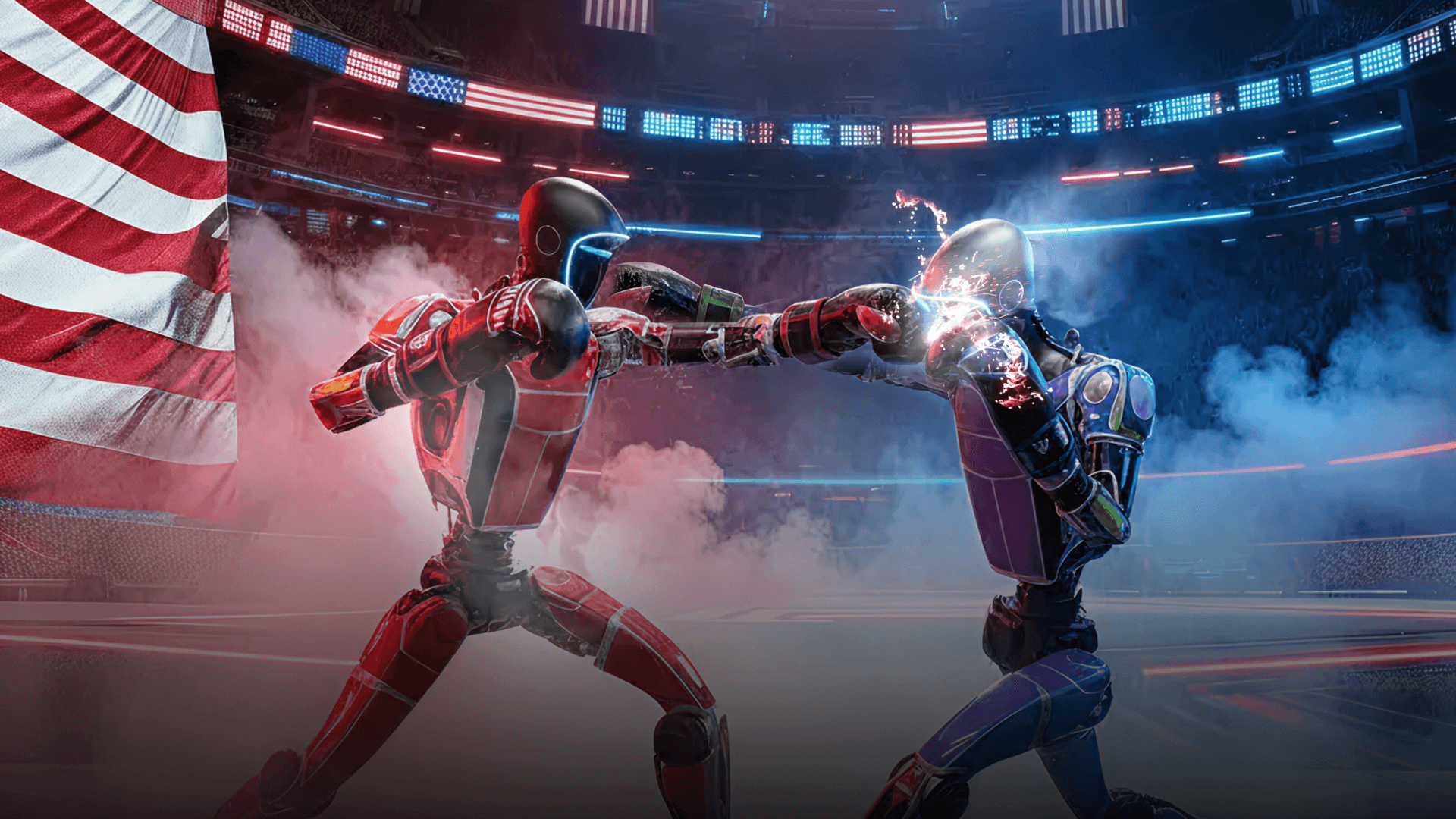

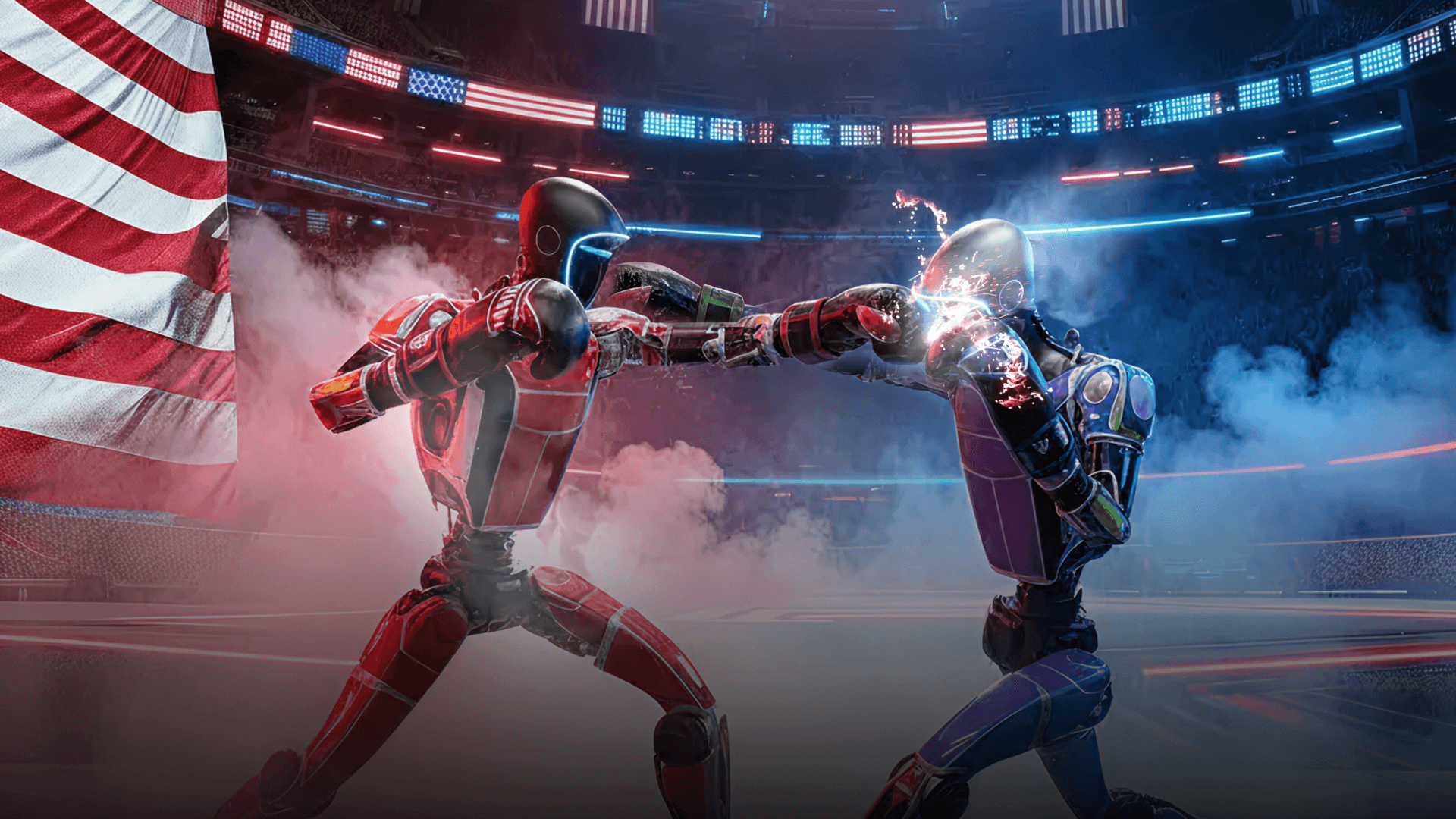

Live-Action Humanoid Robot Combat League

INVESTED

2025

GPU Cloud Backbone for AI Infrastructure

INVESTED

2025

Minimally-Invasive Medical Robotics Startup

INVESTED

2025

Rapid-Scale UAS Built for Immediate Combat Use

INVESTED

2025

Category Leader in Full-Stack Humanoid Systems

INVESTED

2025

Strategic Google Partnership — Embodied Gemini AI

INVESTED

2025

Building & Commercializing General-Purpose Physical Intelligence

INVESTED

2025

Robotic welding systems for enhanced precision and adaptability.

INVESTED

2025

Live-Action Humanoid Robot Combat League

INVESTED

2025

GPU Cloud Backbone for AI Infrastructure

INVESTED

2025

Minimally-Invasive Medical Robotics Startup

INVESTED

2025

Rapid-Scale UAS Built for Immediate Combat Use

INVESTED

2025

Category Leader in Full-Stack Humanoid Systems

INVESTED

2025

Strategic Google Partnership — Embodied Gemini AI

INVESTED

2025

Building & Commercializing General-Purpose Physical Intelligence

INVESTED

2025

Robotic welding systems for enhanced precision and adaptability.

INVESTED

2025

Live-Action Humanoid Robot Combat League

INVESTED

2025

GPU Cloud Backbone for AI Infrastructure

INVESTED

2025

Minimally-Invasive Medical Robotics Startup

INVESTED

2025

Rapid-Scale UAS Built for Immediate Combat Use

INVESTED

2025

Category Leader in Full-Stack Humanoid Systems

INVESTED

2025

Strategic Google Partnership — Embodied Gemini AI

INVESTED

2025

Building & Commercializing General-Purpose Physical Intelligence

INVESTED

2025

Robotic welding systems for enhanced precision and adaptability.

INVESTED

2025

Live-Action Humanoid Robot Combat League

INVESTED

2025

GPU Cloud Backbone for AI Infrastructure

INVESTED

2025

Minimally-Invasive Medical Robotics Startup

INVESTED

2025

Rapid-Scale UAS Built for Immediate Combat Use

INVESTED

2025

PORTFOLIO

Targeting the Breakout Winners of the Robotics Revolution

Category Leader in Full-Stack Humanoid Systems

INVESTED

2025

Strategic Google Partnership — Embodied Gemini AI

INVESTED

2025

Building & Commercializing General-Purpose Physical Intelligence

INVESTED

2025

Robotic welding systems for enhanced precision and adaptability.

INVESTED

2025

Live-Action Humanoid Robot Combat League

INVESTED

2025

GPU Cloud Backbone for AI Infrastructure

INVESTED

2025

Minimally-Invasive Medical Robotics Startup

INVESTED

2025

Rapid-Scale UAS Built for Immediate Combat Use

INVESTED

2025

Category Leader in Full-Stack Humanoid Systems

INVESTED

2025

Strategic Google Partnership — Embodied Gemini AI

INVESTED

2025

Building & Commercializing General-Purpose Physical Intelligence

INVESTED

2025

Robotic welding systems for enhanced precision and adaptability.

INVESTED

2025

Live-Action Humanoid Robot Combat League

INVESTED

2025

GPU Cloud Backbone for AI Infrastructure

INVESTED

2025

Minimally-Invasive Medical Robotics Startup

INVESTED

2025

Rapid-Scale UAS Built for Immediate Combat Use

INVESTED

2025

Category Leader in Full-Stack Humanoid Systems

INVESTED

2025

Strategic Google Partnership — Embodied Gemini AI

INVESTED

2025

Building & Commercializing General-Purpose Physical Intelligence

INVESTED

2025

Robotic welding systems for enhanced precision and adaptability.

INVESTED

2025

Live-Action Humanoid Robot Combat League

INVESTED

2025

GPU Cloud Backbone for AI Infrastructure

INVESTED

2025

Minimally-Invasive Medical Robotics Startup

INVESTED

2025

Rapid-Scale UAS Built for Immediate Combat Use

INVESTED

2025

Category Leader in Full-Stack Humanoid Systems

INVESTED

2025

Strategic Google Partnership — Embodied Gemini AI

INVESTED

2025

Building & Commercializing General-Purpose Physical Intelligence

INVESTED

2025

Robotic welding systems for enhanced precision and adaptability.

INVESTED

2025

Live-Action Humanoid Robot Combat League

INVESTED

2025

GPU Cloud Backbone for AI Infrastructure

INVESTED

2025

Minimally-Invasive Medical Robotics Startup

INVESTED

2025

Rapid-Scale UAS Built for Immediate Combat Use

INVESTED

2025

PORTFOLIO

Targeting the Breakout Winners of the Robotics Revolution

Category Leader in Full-Stack Humanoid Systems

INVESTED

2025

Strategic Google Partnership — Embodied Gemini AI

INVESTED

2025

Building & Commercializing General-Purpose Physical Intelligence

INVESTED

2025

Robotic welding systems for enhanced precision and adaptability.

INVESTED

2025

Live-Action Humanoid Robot Combat League

INVESTED

2025

GPU Cloud Backbone for AI Infrastructure

INVESTED

2025

Minimally-Invasive Medical Robotics Startup

INVESTED

2025

Rapid-Scale UAS Built for Immediate Combat Use

INVESTED

2025

Category Leader in Full-Stack Humanoid Systems

INVESTED

2025

Strategic Google Partnership — Embodied Gemini AI

INVESTED

2025

Building & Commercializing General-Purpose Physical Intelligence

INVESTED

2025

Robotic welding systems for enhanced precision and adaptability.

INVESTED

2025

Live-Action Humanoid Robot Combat League

INVESTED

2025

GPU Cloud Backbone for AI Infrastructure

INVESTED

2025

Minimally-Invasive Medical Robotics Startup

INVESTED

2025

Rapid-Scale UAS Built for Immediate Combat Use

INVESTED

2025

Category Leader in Full-Stack Humanoid Systems

INVESTED

2025

Strategic Google Partnership — Embodied Gemini AI

INVESTED

2025

Building & Commercializing General-Purpose Physical Intelligence

INVESTED

2025

Robotic welding systems for enhanced precision and adaptability.

INVESTED

2025

Live-Action Humanoid Robot Combat League

INVESTED

2025

GPU Cloud Backbone for AI Infrastructure

INVESTED

2025

Minimally-Invasive Medical Robotics Startup

INVESTED

2025

Rapid-Scale UAS Built for Immediate Combat Use

INVESTED

2025

Category Leader in Full-Stack Humanoid Systems

INVESTED

2025

Strategic Google Partnership — Embodied Gemini AI

INVESTED

2025

Building & Commercializing General-Purpose Physical Intelligence

INVESTED

2025

Robotic welding systems for enhanced precision and adaptability.

INVESTED

2025

Live-Action Humanoid Robot Combat League

INVESTED

2025

GPU Cloud Backbone for AI Infrastructure

INVESTED

2025

Minimally-Invasive Medical Robotics Startup

INVESTED

2025

Rapid-Scale UAS Built for Immediate Combat Use

INVESTED

2025

PORTFOLIO

Targeting the Breakout Winners of the Robotics Revolution

Category Leader in Full-Stack Humanoid Systems

INVESTED

2025

Strategic Google Partnership — Embodied Gemini AI

INVESTED

2025

Building & Commercializing General-Purpose Physical Intelligence

INVESTED

2025

Robotic welding systems for enhanced precision and adaptability.

INVESTED

2025

Live-Action Humanoid Robot Combat League

INVESTED

2025

GPU Cloud Backbone for AI Infrastructure

INVESTED

2025

Minimally-Invasive Medical Robotics Startup

INVESTED

2025

Rapid-Scale UAS Built for Immediate Combat Use

INVESTED

2025

Category Leader in Full-Stack Humanoid Systems

INVESTED

2025

Strategic Google Partnership — Embodied Gemini AI

INVESTED

2025

Building & Commercializing General-Purpose Physical Intelligence

INVESTED

2025

Robotic welding systems for enhanced precision and adaptability.

INVESTED

2025

Live-Action Humanoid Robot Combat League

INVESTED

2025

GPU Cloud Backbone for AI Infrastructure

INVESTED

2025

Minimally-Invasive Medical Robotics Startup

INVESTED

2025

Rapid-Scale UAS Built for Immediate Combat Use

INVESTED

2025

Category Leader in Full-Stack Humanoid Systems

INVESTED

2025

Strategic Google Partnership — Embodied Gemini AI

INVESTED

2025

Building & Commercializing General-Purpose Physical Intelligence

INVESTED

2025

Robotic welding systems for enhanced precision and adaptability.

INVESTED

2025

Live-Action Humanoid Robot Combat League

INVESTED

2025

GPU Cloud Backbone for AI Infrastructure

INVESTED

2025

Minimally-Invasive Medical Robotics Startup

INVESTED

2025

Rapid-Scale UAS Built for Immediate Combat Use

INVESTED

2025

Category Leader in Full-Stack Humanoid Systems

INVESTED

2025

Strategic Google Partnership — Embodied Gemini AI

INVESTED

2025

Building & Commercializing General-Purpose Physical Intelligence

INVESTED

2025

Robotic welding systems for enhanced precision and adaptability.

INVESTED

2025

Live-Action Humanoid Robot Combat League

INVESTED

2025

GPU Cloud Backbone for AI Infrastructure

INVESTED

2025

Minimally-Invasive Medical Robotics Startup

INVESTED

2025

Rapid-Scale UAS Built for Immediate Combat Use

INVESTED

2025

KEY FACTS

RoboStrategy Fund

Fund Name

RoboStrategy, Inc.

Adviser

FP Strategies LLC

Domicile

Maryland

holdings

7 Portfolio Companies

Valuation

Monthly NAV

transfer agent

Computershare Trust Company

Apptronik

Dec 4, 2025

Trump administration looks to supercharge robotics industry, Politico reports

Apptronik

Nov 15, 2025

Google Backed Apptronik in Talks to Raise Funding at $5 Billion Valuation

Figure

Oct 6, 2025

Figure 03 Trailer

Dyna

Sep 24, 2025

Dyna long-horizon dexterous VLA

Figure

Sep 16, 2025

Figure reaches $39B valuation in latest funding round

Dyna

Sep 15, 2025

Dyna Robotics Raises $120m in Funding

Figure

Sep 11, 2025

Humanoid Robots for BMW Group Plant Spartanburg.

Apptronik

Sep 8, 2025

Mechanism Capital: Our Investment In Apptronik

Apptronik

Jun 10, 2025

Apptronik: 2025 CNBC Disruptor 50

Apptronik

Dec 4, 2025

Trump administration looks to supercharge robotics industry, Politico reports

Apptronik

Nov 15, 2025

Google Backed Apptronik in Talks to Raise Funding at $5 Billion Valuation

Figure

Oct 6, 2025

Figure 03 Trailer

Dyna

Sep 24, 2025

Dyna long-horizon dexterous VLA

Figure

Sep 16, 2025

Figure reaches $39B valuation in latest funding round

Dyna

Sep 15, 2025

Dyna Robotics Raises $120m in Funding

Figure

Sep 11, 2025

Humanoid Robots for BMW Group Plant Spartanburg.

Apptronik

Sep 8, 2025

Mechanism Capital: Our Investment In Apptronik

Apptronik

Dec 4, 2025

Trump administration looks to supercharge robotics industry, Politico reports

Apptronik

Nov 15, 2025

Google Backed Apptronik in Talks to Raise Funding at $5 Billion Valuation

Figure

Oct 6, 2025

Figure 03 Trailer

Dyna

Sep 24, 2025

Dyna long-horizon dexterous VLA

Figure

Sep 16, 2025

Figure reaches $39B valuation in latest funding round

Dyna

Sep 15, 2025

Dyna Robotics Raises $120m in Funding

Figure

Sep 11, 2025

Humanoid Robots for BMW Group Plant Spartanburg.

Apptronik

Sep 8, 2025

Mechanism Capital: Our Investment In Apptronik

Targeted Exposure to Robotics

The fund provides direct access to a curated portfolio of leading private companies at the forefront of robotics and embodied artificial intelligence—an asset class traditionally reserved for venture capitalists and deep-tech insiders.

The fund provides direct access to a curated portfolio of leading private companies at the forefront of humanoid robotics and embodied artificial intelligence—an asset class traditionally reserved for venture capitalists and deep-tech insiders.

Disclaimer

RoboStrategy is a non-diversified, closed-end management investment company registered under the Investment Company Act of 1940, as amended. By using this website, you agree to our Terms of Use and Privacy Policy. The information on this site is provided for informational purposes only and does not constitute an offer to sell, or a solicitation of an offer to buy, any securities.

© ROBOSTRATEGY 2025

Disclaimer

RoboStrategy is a non-diversified, closed-end management investment company registered under the Investment Company Act of 1940, as amended. By using this website, you agree to our Terms of Use and Privacy Policy. The information on this site is provided for informational purposes only and does not constitute an offer to sell, or a solicitation of an offer to buy, any securities.

© ROBOSTRATEGY 2025

Disclaimer

RoboStrategy is a non-diversified, closed-end management investment company registered under the Investment Company Act of 1940, as amended. By using this website, you agree to our Terms of Use and Privacy Policy. The information on this site is provided for informational purposes only and does not constitute an offer to sell, or a solicitation of an offer to buy, any securities.

© ROBOSTRATEGY 2025

Disclaimer

RoboStrategy is a non-diversified, closed-end management investment company registered under the Investment Company Act of 1940, as amended. By using this website, you agree to our Terms of Use and Privacy Policy. The information on this site is provided for informational purposes only and does not constitute an offer to sell, or a solicitation of an offer to buy, any securities.

© ROBOSTRATEGY 2025